Between resilience and growth

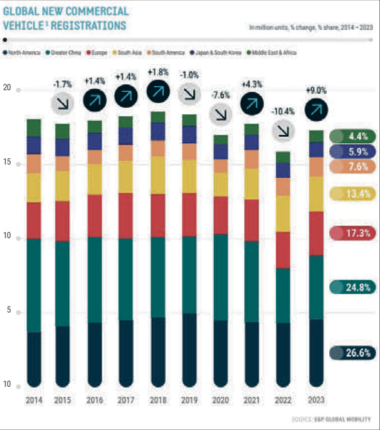

Based on figures from S&P Global Mobility, ACEA reports that the global market for commercial vehicles over 3.5 tonnes) declined by 0.9% in 2024.

This slight downturn comes after a strong performance in 2023. Various projections anticipate healthy momentum over the next few years. The growing logistics needs of regional economies - particularly last-mile logistics - and new infrastructure, combined with increasingly sophisticated technology, point to a generally bullish market. This will lead to a growing need for maintenance downstream.

Asia at the centre of the world

With a 42% market share, 24.3% of which for China alone, the Asia-Pacific region is currently the largest market for heavy-duty vehicles. Between rapid urbanisation and huge new infrastructure construction projects (particularly in China and India), swift industrialisation and growing logistics, the needs are enormous! Of particular note is the significant market penetration rate of electric vehicles in China's light commercial and heavy goods vehicle sales, estimated at 25%. Meanwhile the South Asia region and, to a lesser extent, Japan and South Korea, saw a decline in 2024.

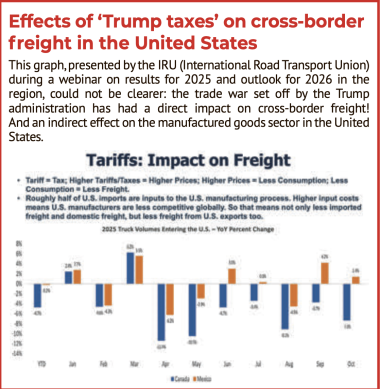

The more mature North American market (United States-Canada-Mexico) performed well, increasing its share of total sales from 26.6% to 27.2% between 2023 and 2024. In this market dominated by large transport fleets, logistics - driven in particular by e-commerce - had a positive impact on the market: the 3,800 dealerships registered some 498,000 vehicles. In the first half of 2025, the region also recorded one of the strongest increases in commercial vehicle sales (+10%). But the higher segments are clearly slowing down! According to data from the American Truck Dealer Association, the US market, impacted by additional tariffs imposed by the admi-nistration, is expected to see the 'medium' and 'heavy' segments decline by 10%. The transport sector is certainly not keen on changing regulatory frameworks.

Europe slows down in the face of the energy transition

While 2023 and 2024 were years of growth in the European market which accounted for 17.3% then 18.2% of global sales respectively, 2025 is not expected to follow this upward trajectory: over the first nine months of the year, ACEA reveals that volumes have actually fallen by 8% for vans and 10% for trucks. The market is stalling owing to the economic environment and the significant investments required to make fleets greener: indeed, the regulatory framework has become much stricter in recent years. And while Brussels announced in mid-December that it would allow car manufacturers more flexibility (and pragmatism) in the decarbonisation trajectory imposed to date, it also indicated that a new review would be conducted on the commercial vehicle sector. So far, apart from in passenger transport and very specific applications, demand for zero-emission vehicles has not taken off in these vehicle segments. The vast majority of transport companies opt for gas or biodiesel.