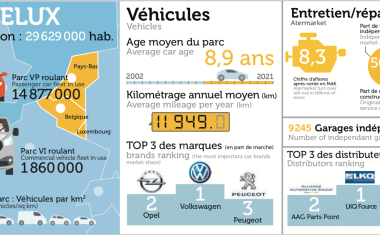

[Atlas] Benelux: aftersales convergence, consolidation, optimization in 2021-2022

While Allal Boukouch, from GiPA, observes the convergence of Belgian and Dutch consumer behavior, the three leaders are strengthening their positions and refining their strategy.

GiPA • ALLAL BOUKOUCH • Director Benelux : Heading towards the convergence of aftersales models

New vehicle market and primary network

Allal Boukouch: Following a 20% drop in 2020, sales of new vehicles should end 2021 at -10%. Over the next three years, the situation is likely to remain difficult for vehicle manufacturer networks. As the first to be impacted by the growing electrification of the fleet, their garages will also be hit by the ageing of the fleet due to the absence of new vehicle sales.

The aftersales landscape

A.B.: After the collapse in 2020, the recovery of 2021 has not enabled the ecosystem to return to 2019 levels, even if the mileage drop of 2020 (-22%) was almost totally recouped in 2021. The way out of this crisis may prove fatal to weak garages. We are seeing a convergence in both countries of consumer behaviour (less diesel and a rise in used vehicles in Belgium) and in maintenance offers. Highly innovative and multi-service, the Dutch have long been at the forefront of garage concepts. On the other hand, Belgium, dominated by a young fleet which should be more beneficial for automaker networks, has seen little development in garage networks (with the exception of Bosch Car Service, Auto5 Midas and 1,2,3 AutoSevice). But the groups are accelerating in Belgium on their garage brands with the ascendancy of Eurorepar Car Service (Distrigo/Stellantis), Quality (LKQ), AD and 1,2,3 AutoService (PHE-Autodistribution-Doyen). The battle should continue to be about service innovations and logistical efficiency.

Concentration of independent distribution

A.B.: In Benelux, there have been some very strong concentration operations in recent years. In 2021, this concentration continued imperceptibly. Positions have virtually reached maturity in the Netherlands, whereas there are more acquisition opportunities in Belgium. LKQ-Fource is the leader thanks to a strong position in the Netherlands, ahead of AAG and PHE-Doyen (Autodistribution), the leader in Belgium. Nexus Automotive International and WM-Automaterialen are looking to occupy the remaining places.

PHE : Doyen Auto Nederland becomes Autodistribution

Parts Holding Europe capitalises on its Autodistribution brand, which further rein- forces its European identity. Another step towards the integration of the Dutch subsidiary in the Autodistribution family, PHE’s flagship brand. In September this year, the wholesalers at API/Doyen had already been invited to deploy the AD Garage concept, replacing Requal (also the brand of their private label). Around 20 garages display the “redtriangle”. It can be surmised that the aim is to place distributors and garages under the same banner to assert its footprint.

This strategy can be compared to the cultural revolution initia- ted by LKQ Europe, which replaced the historical brand Van Heck Interpieces by LKQ Belgium on the shop fronts of subsidiaries. Or the more recent initiative by Alliance Automotive Group which founded its “international” brand PartsPoint.

AAG : Consolidation in the Netherlands

Three years after setting foot in the Netherlands, major operations are underway on the Dutch market at AAG , which is consolidating under the PartsPoint banner and launching Précisium. On January the 1st 2022, the hundred or so AAG subsidiaries will all fly the same flag. The PartsPoint logo will be displayed by Brezan (which will keep its name in Belgium), Staadegaard, TC and Dabeko.

A necessary consolidation of its acquisitions, which are still continuing. For example, in spring, the group bought up the online parts platform Winparts (€35 million turnover). Shortly afterwards, it acquired the distributor Hacos (North Brabant province). Another strategic manoeuvre which began at the end of 2021: the launch of Précisium, the French retail brand. AAG Benelux announces that in early 2022, 25 wholesalers (35 branches) will operate under this brand. Is this a riposte to the independents claimed by GroupAuto Nederland? Indeed, at the beginning of the year, 35 retailers joined forces under the AllParts label to create critical mass and assert their independence in response to the growth of the three European distribution leaders.

LKQ EUROPE : Reinforced logistics

In addition to the operational launch of its logistics mega hub at the beginning of 2021, LKQ rounded out its geographical coverage in both Belgium and the Netherlands. In October 2021, LKQ Belgium inaugurated its 22nd subsidiary. Established in Nannine (Namur), this regional logistics centre (4000 m2) – resulting from the acquisition of the Namur company Henrard – is set to reinforce the distributor’s footprint in Wallonia. In 2022, an additional 800 m2 will be added to accommodate paint shop activities. In the Netherlands, it was through the acquisition of the wholesaler Hamu Automaterialen (€30 million turnover in 2020), covering the centre of the country with nine distribution sites, that LKQ filled out its network. Altogether in Benelux, LKQ Europe has nearly 115 points of sale. But clearly the big investment by the European number one in these countries is the LKQ Europe cen tral logistics hub established in Berkel en Rodenrijs (near Rotterdam), which has been operational since early 2021 and spans 50,000 m2, with a stock of up to 130,000 parts. Apart from improving service to Dutch clients, the distribution centre is also used as a pivotal hub to support supplies to the Belgians... and to the French.