China, an adopter of “test and learn”

Since 2023, China has become the world’s leading exporter of vehicles – ahead of Japan – with 4.9 million vehicles, of which one million for SAIC alone (MG and Maxus makes). The size of the Chinese market is as large as the North American and European ones combined!

The country sold 30.16 million vehicles, 31% of them new energy vehicles*, and 85% of domestic market share is held by local manufacturers including BYD, SAIC, FAW, Geely and Chang'an. Volkswagen's market share, despite having been the leader in China for decades, has fallen to around 10%.

*Battery electric, plug-in hybrid and fuel cell vehicles

A market on drip feed from the government

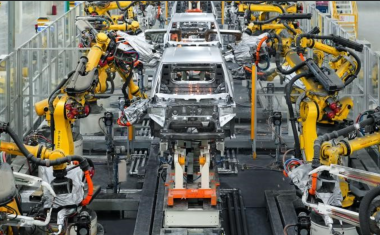

The Chinese government has injected €66 billion in subsidies. While Tier 1 equipment manufacturers still dominate the market (through joint ventures), Chinese suppliers such as BHAP, CATL and HASCO are knocking at the door. Finally, government policy, which encourages the sharing of modules between manufacturers, is enabling them to benefit from economies of scale, making their production costs much lower now than those of European manufacturers. Electric vehicles have proven to be gamechangers due to the ease with which they can be designed and assembled, and now bring together players from the automotive, battery, digital and tech industries, all of whom have vast financial resources. Vehicles manufactured in China have grown from 2% of the European market in 2020 to 14% today. "Chinese manufacturers are trying to make their mark through technology, not just batteries but also digital technology and connectivity. Hence their decision to turn the passenger compartment into a leisure space. The next step is already planned: the Chinese government plans to become the main player in airspace between 100 and 500 metres altitude, whether through drones, flying cars or electric aircraft,” said Jérémie Ni, managing director of ChinForm, at the IBIS Global Summit.

Everything up for grabs in the aftermarket

When it comes to aftersales, the Chinese have a ‘test and learn’ culture. Manufacturers launch their new vehicles before they have put in place the necessary infrastructure for aftersales service. Releasing electric brands that are then abandoned if sales don't take off - creating graveyards of electric vehicles on the road - costs nothing and the investment will have been contained. “Electric vehicles face the paradox of having a less dense aftersales network than combustion-powered vehicles, with workshops mainly available in the 20% of towns with 80% of the population and an average journey time of 50 minutes, compared with 15 minutes in Europe in general and France in particular. As a result, there is a greater need to use approved workshops, often with extended vehicle warranties of five years and battery warranties of eight years,” notes Serge Cometti (consultant). The aftermarket sector is still fragmented, as noted by China Insights Consultancy, which estimated the market at $244 billion by 2030. An electrifying prospect.