MEA Market Dynamics: Everyone at their own speed

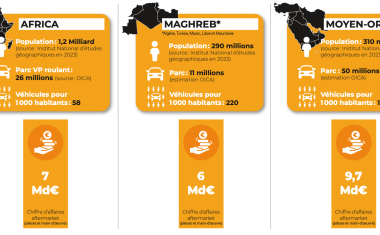

The Middle East, Africa, and Maghreb present three distinct markets within a vast business space brimming with opportunities for after-sales players. There is a growing parc and an evolving maintenance ecosystem.

The automotive spare parts market in the Middle East and Africa was valued at $40 billion in 2023 and is projected to reach $69 billion by 2030, according to Virtue Market Research. Spare parts account for 60% of this total, with 40% of sales facilitated through manufacturer networks. In 2023, the MEA region represented 12.3% of the global spare parts market, marking it as a potential growth engine for many players. Increasing numbers of cars and climatic conditions driving demand for maintenance, including tyres, batteries, and suspension, underscore its importance. However, the region’s vast and disparate nature necessitates highly targeted and non-volume-based strategies.

Africa: a market still to be built

“This continent is particularly fragmented, with countries requiring individual approaches tailored to their unique needs and cultures. This makes it highly complex. Moreover, apart from South and North Africa, manufacturers are not well-established, which often hampers the development of supply chains,” explains Warren Espinoza, CEO of ATR International. Beyond South Africa, the continent’s automotive ecosystem, spanning sales and after-sales, remains underdeveloped across its 52 nations. Manufacturers, ITGs, and equipment suppliers are increasingly drawn to these smaller, complex markets as potential growth drivers. For instance, Nexus IAMaga has initiated the Africa Feeder project to transform trade and practices in the sector. The agenda includes tackling counterfeiting, simplifying supply chains, reducing trade barriers, and optimising data. Ghana and Ivory Coast have attracted attention, with each generating aftermarket turnover of €300 million. Vehicle imports for both passenger cars and heavy goods vehicles have grown at an average annual rate of 10% over the past six years, with spare parts imports following the same trajectory.

Maghreb: things are stuck in Algeria

After halting imports, Algeria reopened them in May 2023 under Algex, a regulatory body issuing export passes, excluding French companies, which remain blacklisted. This restrictive environment has paralysed a once-healthy market. Although Algex oversees imports, persistent administrative blockages disrupt the supply chain. As a result, local distribution groups report revenue losses of up to 40%. The Algerian government aims to foster “Made in Algeria” initiatives, encouraging local production. While this strategy seeks to create a €2 billion aftermarket business—the second largest in Africa, alongside Egypt and behind South Africa—the market remains tense. Morocco (€1 billion) and Tunisia (€500 million) have been unable to revitalise the Maghreb market for Western suppliers.

Strong growth in the Middle East

Saudi Arabia (49%), the UAE (24%), and Qatar (10%) dominate the Middle East’s vehicle parc of 18.6 million cars*. The penetration of electric vehicles, however, is expected to remain low, at 0.5%–2% by 2025. In 2024, aftermarket revenues are projected to reach $12 billion, up from $7 billion in 2020, with spare parts comprising nearly 60% of this total. There is a strong dynamic in the six countries of the region. While manufacturer-backed workshops are prevalent in Gulf countries, independent workshop networks are gaining ground, providing cost-effective yet high-standard services. Niche services catering to specific demographics, such as the Chinese expatriate community and female customers, are also on the rise.

*Source: Frost & Sullivan