Towards a new economic world order

In an automotive market hit by increasingly aggressive global competition from China, the industry’s established players – manufacturers, parts suppliers and distributors alike – are working to reinvent their business models and refocus their priorities, both financially and geographically. They need to move forward in order to continue creating value.

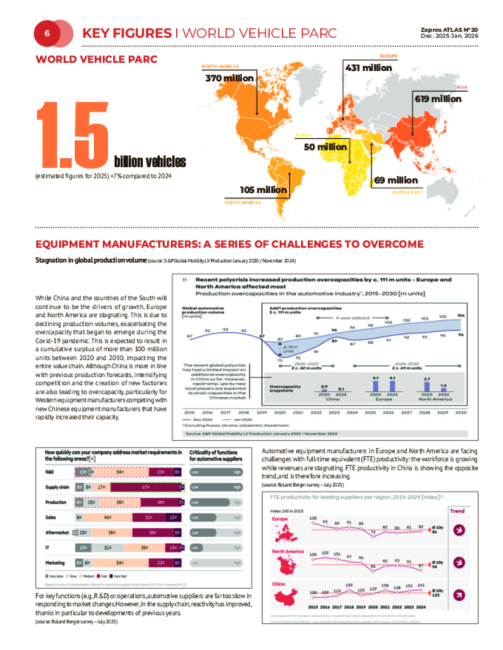

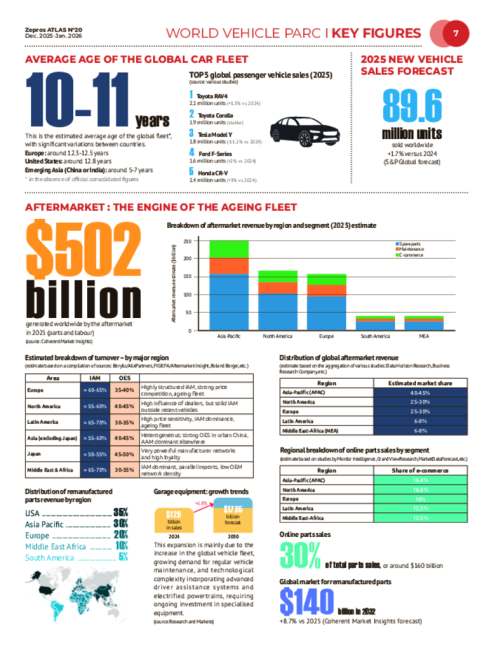

In an environment that is destabilising for original equipment manufacturers, aftermarket business remains buoyant, with consolidated global sales estimated at around $500 billion, which analysts continue to see climbing by 3% per year to reach $550 billion in 2030 (Mordor Intelligence forecast). 2025 will have been a mixed year for the players in the ecosystem surveyed by Zepros, all of whom come from the ‘traditional movement’ sphere, still very active in mature markets. In Europe in particular, business was at best flat in 2025, with distributors facingpressure on their margins, fluctuating delivery times and a decline in their customers’ purchasing power, but with an ageing fleet still driving growth. The same stability was seen in the American market, also driven by an ageing fleet but held back by inflationary policies. Growth is ultimately driven by the so-called emerging countries, whose presence is indeed increasingly visible: China, Southeast Asia, India and Latin America but also Africa, which is beginning to show signs of the solid growth that has been long awaited. In order to keep the indicators in the green, manufacturers must expand their footprint and even shift their centre of gravity.

Chinese manufacturers at the helm?

These markets are growing in terms of spare parts but are reluctant to pay Western prices and therefore attracted by Chinese ranges, which, according to Clepa (the European Association of Automotive Suppliers), have a competitive advantage of 15 to 35% over European manufacturers. China has become the global centre of gravity for the automotive industry, accounting for around a third of global vehicle production, leading to the rise of local parts suppliers who are beginning to establish themselves in Europe through acquisitions, joint ventures and local factories. “In Latin America, the Middle East, Africa and parts of Asia, Chinese vehicles account for a signifi cant share of imports, and their spare parts naturally follow this trend. In Europe, however, Chinese manufacturers operate more discreetly, through private labels and specialised ranges rather than direct competition. Some brands are now so well established that they have even surpassed their original counterparts”, notes a seasoned observer. In the early 2010s, only one Chinese group was among the Top 100 global automotive suppliers; today, there are around ten. “The Chinese parts market is one of the most dynamic. We are well prepared for competition in China and we must prepare to face competition from Chinese parts suppliers in other parts of the world”, acknowledges Philipp Grosse Kleimann, General Manager of MAHLE Lifecycle and Mobility.

Defensive tactics

Are Western suppliers capable of taking on this Chinese offensive? First, one parts supplier notes that Chinese vehicle manufacturers protect their data, making it difficult for manufacturers to supply parts of equivalent quality for Chinese cars. However, Western parts suppliers have Chinese manufacturers at the helm? And they need to move fast, because they will need to contend with a Chinese offensive with its incisive global sales, particularly in the Asian, South American and African markets. faith in their ability to compete technologically. “The advantage for a manufacturer like ZF is that we have always invested in our expertise and technology”, notes Alex Gelbcke, Senior VP Aftermarket Europe at ZF. While they are still dominant, they therefore remain one step ahead, “but they are also weakened by the ever-increasing cost of staying competitive”. European parts suppliers are under pressure and are therefore demanding a ‘premium’ for production located in Europe, while sharing a conviction when it comes to the aftermarket: their best defence remains to hold fi rm and maintain a high-end positioning in terms of both product quality and service for suppliers. The midrange segment is, after all, the one in which battle rages the most. The same ‘salvational’ strategy applies to distributors facing ever-increasing competition from e-commerce for parts, but also from vehicle manufacturers who seem to be starting to ‘nibble away’ at the market share of independents, which could, in the long term and with the rise of electric technologies, be knocked off their pedestal. A new automotive world order is indeed beginning to take shape.