Will it be enough for the balance to swing from the consumer-motorist towards trade customers in garages who represent nearly 50% of online parts shoppers? Or will newcomers - like the Otop concept in France launched by former Doyen executives (see page 66) - force them to react? "The biggest e-players in Europe soon realized that garages will buy their parts online but only in the premium segment. So all of them supply with linked services" explains Sylvie Layec (TMD). Exist.ru in Russia, or the French Mister Auto bought by PSA and today present in 19 countries, have clearly gone down this route. The German Autodoc (€254 million in 2017), which covers 24 European markets, still says that 90% of their business is with private individuals, but its strategy may well evolve. And then there is Oscaro from France, a European pioneer in online parts sales that has shaken up the market without ever setting up sales for the trade. But what will be the strategy of this site that reports a turnover of €320 million after its rescue last November by PHE (ex-Autodis)? Will the leader of the French market maintain the strategy of sales to the public or succumb to the temptation to look for a recovery through professional sales? A position that would be difficult to sustain against its partners in traditional parts distribution. In the meantime, the French company will have to turn the company around and export this wonderful digital tool, as have Mister-Auto and Autodoc. Will this takeover, considered by some unnatural and by others as a tactical masterstroke, force the two other European leaders to accelerate their digital strategy? Alliance Automotive Group is looking on cautiously with a wait and see policy while recognizing that its main shareholder, GPC, is currently testing an online sales site in the US. LKQ Europe does not hide the fact that it is has speeding things up on this question starting with the experience of its UK subsidiary Euro Car Parts. Because the question of whether to move online or not is no longer posed.

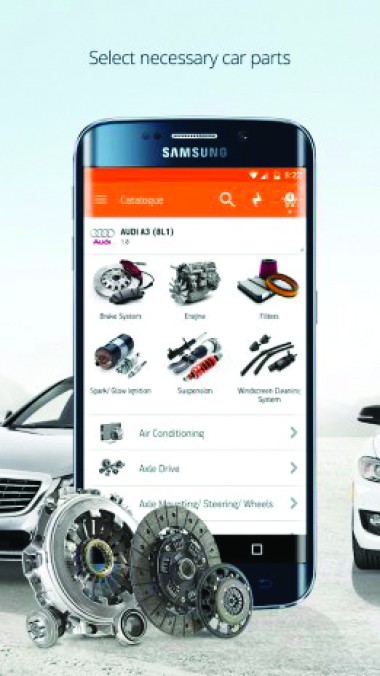

Must-have e-shopAll these initiatives and market shares that are growing online have led some to launch omnichannel strategies. In Eastern Europe, online purchases have long been the norm with the Russian site Exist.ru. Also in Russia, Norauto, the French chain of auto centres, has just opened its online store from Moscow. Inter Cars proposes online orders in all the markets where the Polish leader has a logistics setup and also heads up the Motointegrator site. In the West, the German Kfzteile24 (phygital format with three points of sale) and ECP (70% of orders go through the website) from the UK have also managed to establish their sites in their territories, but without significant positions elsewhere. And locally, more and more wholesalers are using their online ordering platforms as a lever to gain the loyalty of their garage customers. Some OEMs are considering creating e-shops to push their products to markets where their brands are not present. SKF is expected to announce a project later this year. So it's a done deal: online sales have become a must in the spare parts business.