Back to basics: the customer is king!

15,000 drivers surveyed worldwide, representing a wide range of cultural codes and car usage patterns, and yet five common proposals in 13 countries around the world emerge from this highly informative survey by the Cetelem Observatory.

How can sluggish sales be revived? With simpler, less expensive cars that have less superfluous technology but come with subsidies, if they are electric vehicles. One guiding principle emerges for the industry: listen to the customer! New vehicle sales have fallen short of replacement demand by more than 20 million vehicles in Europe since 2020, negatively affecting the occupancy rates of underutilised factories and creating social disruption with factory closures and relocations. The broader geopolitical and economic picture is no more reassuring. Sales of electric vehicles are stagnating due to high prices and consumer resistance to change, while government subsidies are declining, also affecting demand. Meanwhile, China is exporting its vehicles on a massive scale, particularly heavily subsidised electric ones, leading to a price war and reducing profit margins. In this context, the findings of the Cetelem Observatory, based on a survey of 15,774 people conducted online over 12 days in 13 countries (nine in Europe + the United States, Japan, China and Türkiye), converge around the principle of efficiency through simplicity.

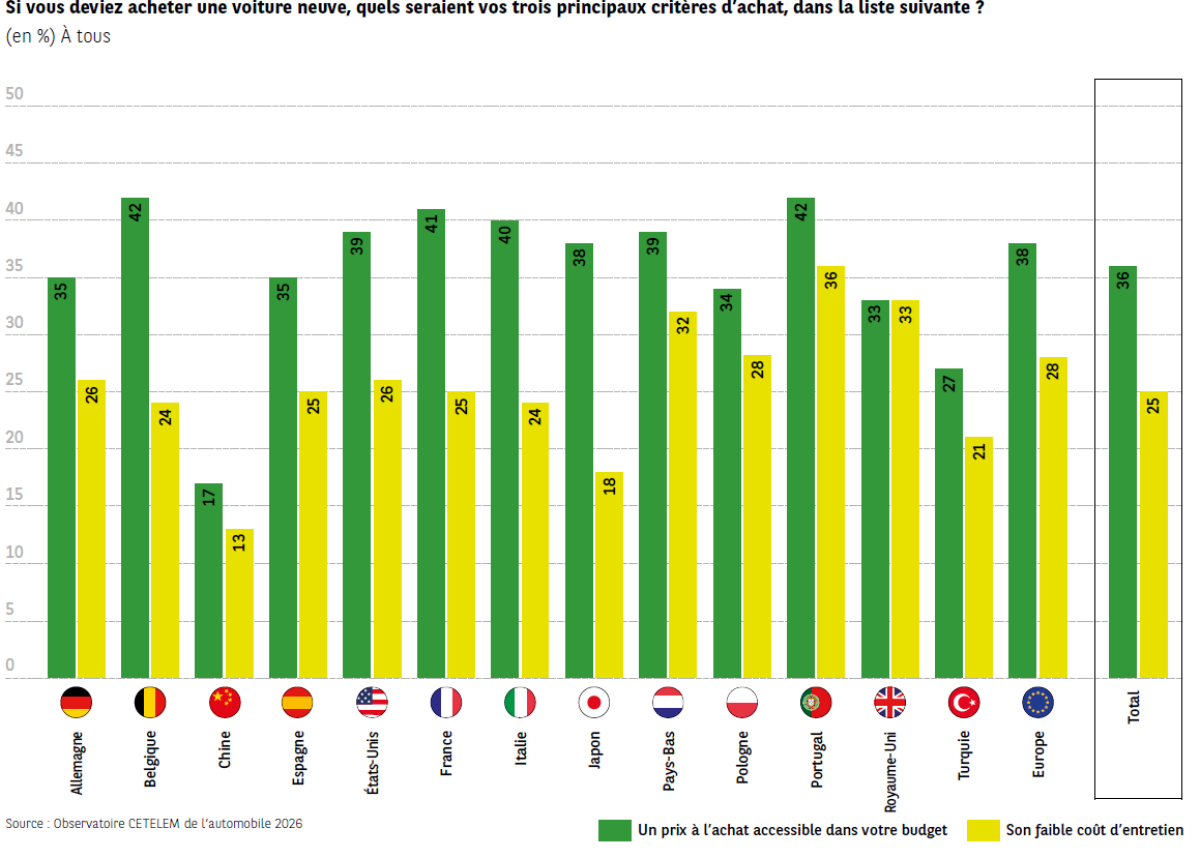

Lowering prices is a priority

The verdict is unanimous: 89% of respondents consider new vehicles to be too expensive! Only China bucks this trend (55%), with customers generally satisfied with prices in a heavily subsidised market. Meanwhile in Europe, 60% believe that price rises are unjustified. Between 2000 and 2019, prices rose twice as fast as inflation, with an acceleration since 2020 and an illusion of ‘pricing power’ during the shortage of electronic components. Many believe that manufacturers “took advantage of this period to increase their margins”. As a result, 74% believe that lower vehicle prices require lower manufacturer margins... While admitting that to influence prices, the production site may need to be adapted. Another consequence: 58% emphasise the need for mass production in countries with low labour costs, even given the social and environmental issues that this entails. Japan, on the other hand, is the most attached to domestic production, with only 42% of respondents willing to offshore...

Simplify the offering at all costs

In the Top 5 criteria that can be reduced to make a car cheaper:

• 32% want fewer options (colours, alloy wheels, upholstery, etc.)

• 26% want fewer driver assistance features (semi-autonomous driving, sensors, parking and lane assists, etc.)

• 24% want smaller vehicles

• 23% want fewer audio and multimedia systems

• Finally, for 74% of these global customers, a smaller range of models, even if it means having less choice, would be the most sensible solution for lowering the price (81% of French and 72% of American customers). And 64% would prefer a used or reconditioned vehicle.

Simpler vehicles in every sense of the word to reduce costs! This is obvious to the customer, but perhaps less so to the brand...

Public subsidies: making sense of the tax jungle

The lack of clarity on public subsidies and untimely changes to the rules are a barrier to purchase. Customers want a sustainable, affordable financial system for everyone, both individuals and businesses, even if this means supporting government-imposed price ceilings (74%).

• Only 53% believe that public policies are heading in the right direction (41% in Italy, 44% in France, similar figures in Germany).

• 68% of Europeans consider the rules on purchasing subsidies and bonuses to be unclear.

• 73% note that ‘things are constantly changing’, which leads to a wait-and-see attitude, and call for a return to regulatory standards that are complex to implement.

• 68% of French people want purchasing incentives to be maintained, particularly for electric vehicles.

The brand is a strong marker

Loyalty to brands and their environment still exists for 69% of international customers (the status symbol of the car). The United States, Germany and France show a strong attachment to old and established brands. Hence the need for brands to have a product plan: 41% of those surveyed are more attentive to new models than before (67% among the Turkish, 58% among the Chinese). This connection includes brand-specific design, which makes a difference for 70% of respondents (89% for Chinese respondents). Visual presence on the street, at motor shows, and through rental companies and taxis remains important.

Manufacturers that do not release new models inevitably lose market share...

100% online purchasing remains a myth

68% of motorists worldwide have a positive image of dealerships and their salespeople, who are rated highly by 67% of respondents, particularly among Chinese, Polish and Spanish consumers. Why is this? Quite simply because they are perceived as being able to understand customers' needs (73%), give good advice (71%), offer suitable financing options (70%) and provide models that meet those needs (69%).

Is it this preference for real contact with the salesperson that divides opinion on 100% online purchasing? Potentially, 49% could follow a completely digital process (information, delivery, payment), but opinions vary greatly from country to country: 79% are in favour in China, 60% in the United States and 50% in Europe. The most reluctant on this issue are the Japanese (26%), the Dutch (33%) and the Belgians (39%). Their barriers to online purchasing include the impossibility to test drive the vehicle and the lack of human contact.

Finally, the negative impact of public policy is the last significant finding of this survey: 49% highlight vehicle distribution being penalised by erratic decisions: carbon taxes, social leasing, administrative complexity, etc.