ITGs refine their transformation

Previously Europe-confined purchasing alliances that have since opened up to the rest of the world, the seven international groups bringing together communities of parts distributors have been work-ing for years to expand their scope. While they have been actively seeking new members and conquering new regions, they have also devoted considerable eff orts to strengtening their portfolio of product and service ranges and expertise. This transformation is necessary in order to survive in an ecosystem undergoing profound change. Work in progress!

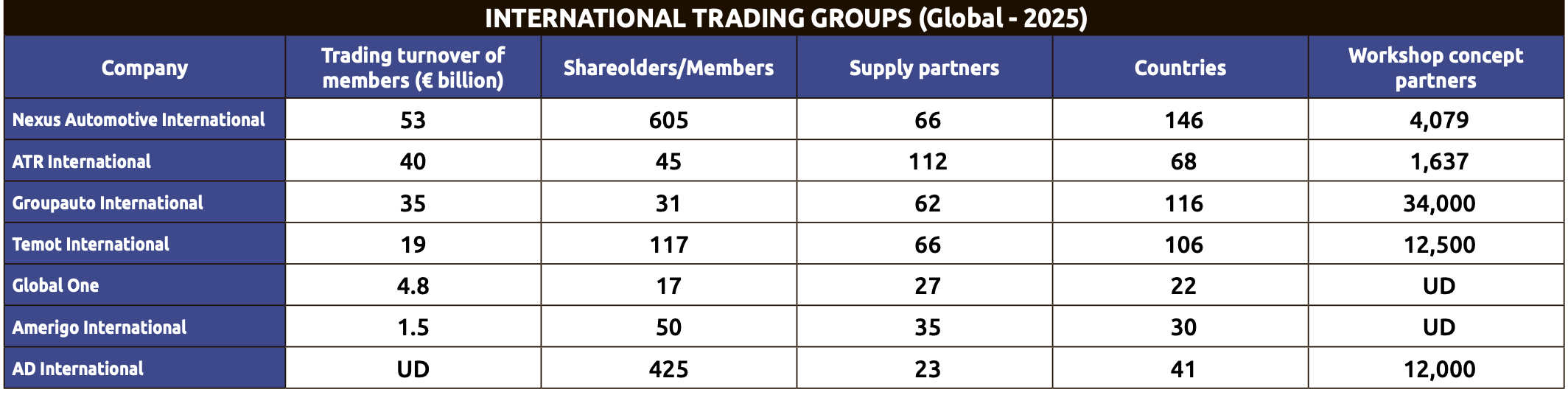

Must the role of theseblisting centres, which have grown significantly over the decades, continue to evolve in order to remain relevant in an increasingly centralised parts market, with multi-specialist global equipment manufacturers facing off against distributors who are also consolidating? The unanimous answer is yes: change is necessary – and even vital – to keep pace with a business undergoing profound change. Seven international groups covering the global parts business have a combined turnover of more than €160 billion among their members, an increase of around 8% compared to the previous year. This volume accounts for nearly 30% of the total aftermarket business generated worldwide! But to continue to attract the driving forces of distribution and convince OEMs to pay (dearly) for listings and a good place in their catalogues, these organisations must strengthen their angle of attack and their sphere of influence with the aim of continuing to create value for members as well as suppliers. The aftermarket business has become more complex... and so has their mission. In addition to their original mission of negotiating agreements with suppliers, they are opening the door to new markets, promoting workshop concepts, contributing to the digitalisation process and espousing the regulatory battles of the IAM. And today, they are focusing heavily on building a solid ecosystem around data, which has become an indispensable source of performance “Nexus accounts for around 8% of the global aftermarket, representing millions of pieces of data collected for exploitation. This influx has led us to establish data as our third pillar. We have recruited a digital expert (Gijsberg Slob, formerly of GPC) to build a global data centre”, explains Gaël Escribe, CEO of Nexus Automotive International. This approach is part of a broader transformation of the ITG, which is retaining its original mission of acting as an intermediary between equipment manufacturers and distributors, but only for 50% of its business, to take on the status of a ‘Group’, like a traditional company, as the rest of its activity is carried out through services and the development of technological innovations.

From ITG to Integrated Technology Group

This paradigm shift can be seen to varying degrees among other ITGs. Temot International is pursuing a strategy of increased selectivity, both in its recruitment of members and in its supplier listings, with a view to making its structure hyper-professional. “We favour long-term relationships. We prefer commitment to tourism. It may not be the fastest or safest route, but it is certainly the most sustainable. Each new member must strengthen the stability, quality and competitiveness of the network”, insists Fotios Katsardis. A great deal of work has been done to optimise agreements through portfolio analysis, commercial performance evaluation, etc. QED: to be successful, an ITG must be efficient! Data management is inevitably part of this transformation. In a sign of a radical change in scale, Fotios Katsardis no longer refers to Temot as an ‘International Trading Group’, but associates the acronym ITG with ‘Integrated Technology Group’.

A wider world

Another major trend that has been underway for several years is the shift in the centre of gravity of aftermarket growth from mature markets (USA, Europe) to so-called ‘emerging’ countries, which these international groups, all European, were slow to take an interest in, largely focused on building the ecosystem of their natural playground, Europe. This presented an opportunity for Nexus, the latest arrival in the ITG world, which, from its launch, played the emerging markets card to expand its footprint. The gamble paid off for the group, which has dominated the market for several years. This approach has been further strengthened by the strategic alliance with another group focused on emerging markets and with a strong presence in the developing African market. “This alliance marks a new era in the world of ITG, at a time when agility, innovation and unity are more essential than ever, particularly as the automotive industry undergoes a profound transformation”, insists Gaël Escribe. The drive to open up new markets is so crucial that even the most ‘Eurocentric’ of the groups, AD International, has set up shop in Dubai to conquer new markets. It is also a question of opening up portfolios to include products for Chinese, electric and other vehicles. “The role of an ITG could be pragmatic: maintaining a balanced portfolio of Western technologies, Chinese indus-trial scale and Indian competitiveness”, notes an informed market observer... An appeal to suppliers to also accelerate these new approaches!

ADI aims to become more global

Currently operating mainly in Europe, AD International is setting out to conquer markets outside the Old Continent. First exposure in Dubai. As everyone is aware, in a Europe generally in decline, except for the still buoyant markets in the south, ITGs have long been seeking their fortune in the emerging and increasingly dynamic regions of Latin America, Asia and the Middle East. ADI is one of the latest to seek to highlight the “International” component of its brand name! In fact, apart from members in Türkiye, Algeria, Morocco and Israel, the group, which covers 41 countries, has remained active only in an enlarged Europe.

New growth avenues

Therefore, in a first for the group, ADI secured a showcase at Automechanika 2025 in Dubai to raise its profile outside the borders of the Old Continent, and in markets where the independent aftermarket ecosystem is still under construction and has strong ambitions. This is a first step towards serious foreign expansion, which could be followed by other forays! The aim is to seek growth, which remains moderate in mature European markets. Markets in which the 425 distributors (3,500 points of sale) who are members of the 23 national distribution organisations that make up ADI “had a good year overall in 2025, as did PHE/Autodistribution, and continue to gain market share. And ADI distributors should continue to grow there, as our coverage of Europe is still imperfect. We are therefore all working hard to add to our network coverage”, says Stéphane Antiglio, President of ADI. This is a first step towards serious foreign expansion, which could be followed by other forays! Towards a new ADI?

ATR still on the rise

The ITG established in 68 countries continues to strengthen its network, particularly in Latin America. With consolidated turnover of €40 billion in 2024, ATR ranks second among international groups behind Nexus International. This position is supported by the contribution of its shareholders, notably European leaders such as SAG, Inter Cars and Meko, American leaders such as LKQ (and its European subsidiary) and AutoZone, and two Asian shareholders, Japan’s Empire Motor and China’s CarZone (a joint venture with e-commerce company Alibaba, with 1,300 stores in China). However, its footprint is more modest on the African continent and in Latin America, where prior to 2025 ATR had only three members, including the foreign company Andes Motor. Early in 2025, it therefore took the initiative of significant.

45 groups represented

ATR thus added five new shareholders to the community, which now comprises 45 groups (287 wholesalers). In Brazil, Furacão (32 branches) and Motors Imports (9 branches) have joined the group, as have Argentina’s DER Distribuciones and Mexico’s SAFE Refaccione (19 branches). Finally, in the Balkans, Mega Auto Parts DOOEL (13 branches) based in North Macedonia has joined the fold. “With all five shareholders, we are gaining strong and market-leading automotive spare parts dealers in their growth markets. They focus on branded spare parts from our premium suppliers and are a perfect fit for ATR and its values”, said Warren Espinoza, CEO of ATR International AG.