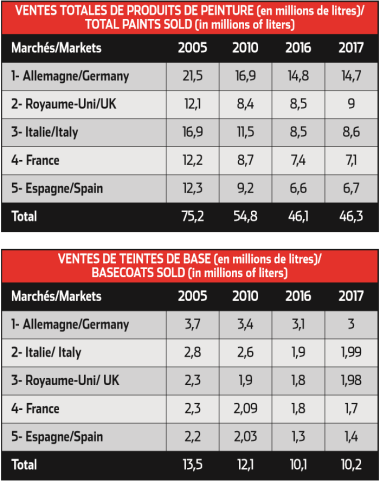

Surprise! Nobody agrees on the order of the leading paint product sellers in Europe. Nonetheless, the top four are, at random, AkzoNobel, Axalta, BASF et PPG. These are followed by smaller Lechler, Mipa, General Paint, Sinnek... Without forgetting Valspar, taken over in June 2017 by Sherwin Williams, the third largest group in the world, which could shake up the rankings. The European market is valued at around €2.2 billion (including non-EU countries). These differences of opinion are not a surprise, since visibility on this market is quite poor. The CEPE (European Council of paint industries) is the only source with figures. But as these are based on (unverified) manufacturer declarations, they are imprecise or simply untrue. However they give an idea of volumes and indicate the five leading consumer markets, in this order: Germany, United Kingdom, Italy, France and Spain. They also show an overall drop in paint sales over 13 years, due to lower accidents and developments in application techniques.Today, the market seems to have levelled off, with an increase of 0.7% on 2017 (source CEPE). Only Germany and France have experienced a slight decline. Sales of water-based basecoats remain stable in the top five countries, while they slightly decrease in the other European regions. In parallel, solvent-based ranges - the repair standard outside the EU - increase overall by 5% and even in the top five countries, despite the fact that water-based paints there are compulsory. This general picture in truth masks major disparities between mature countries with a substantial vehicle fleet (Western Europe) and those who are seeing it still rising (in the east, as far as Russia). These trends are spurring certain manufacturers into looking to conquer market share. And, at the same time, others are seeking to make savings, on markets which demand heavy investment.Nicolas Girault