Electric vehicles: motorists in the fog

If the car remains synonymous with mobility and freedom throughout the world, it is today at a turning point in its history.

In addition to the energy transition that it is undergoing, which is synonymous with an expansion of supply, are ever more restrictive regulations, both in terms of polluting emissions and traffic restrictions. It must also deal with a context in terms of the recent pandemic and geopolitical disruptions for almost two years now. Both have had a severe impact on the global economy. With the first effect being generalised inflation leading to the previous Cetelem Observatory being titled “Very expensive car”. All this leaves many motorists confused when it comes to purchasing a vehicle! The average motorist will find themself in the fog reading the latest Cetelem 2024 Observatory survey. Based on the opinions of 15,000 consumers from sixteen countries*, it highlights their doubts about purchasing a vehicle. Motorists, although they continue to favour the car as a mobility solution, are today “losing their bearings”, notes the credit organisation. Between regulatory frameworks and a confusing array of technologies, which are often opaque for newcomers to the topic, many prefer to wait for now when it comes to a purchase decision. This is not good news for manufacturers. One positive point all the same is that this hesitation regarding the purchase of a new vehicle leads to the aging of the vehicle fleet which is good news for after-sales players!

* Study conducted online from 28 June to 17 July by Harris Interactive among a panel of 15,000 people from the main European markets as well as the UK, Turkey, the USA, Mexico, China and Japan.

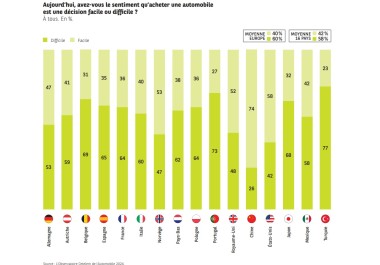

Buying a car: a difficult decision

In this inflationary context, deciding to purchase a vehicle is not without its problems. This is the case for six out of ten people surveyed. The decision can sometimes prove to be very difficult, for example for Turkish or Portuguese motorists, who say so at rate of 77% and 73% respectively. At the other end of the spectrum, only 26% of Chinese say it is a difficult decision. To a lesser extent, American (42%), Norwegian (47%) and British (48%) motorists follow.

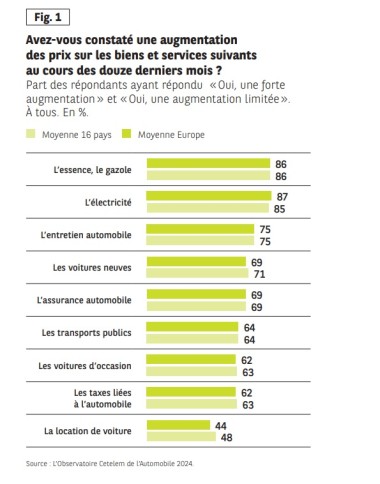

Expensive maintenance

Last year already, the cost of a vehicle in terms of both purchase and use appeared too high for 60% of respondents. The Observatory notes once again a strong sense of increasing prices this year, in all factors linked to the car. It is energy which seems to have increased the most with fuel (86% of respondents) and electricity (85%) in the top two places for items that have increased the most. And in third place is maintenance (75%), ahead of the price of new cars. Many motorists also fear that maintenance costs will continue to increase in the next five years (78%). They think that running costs for a vehicle are greater than the cost of buying it.

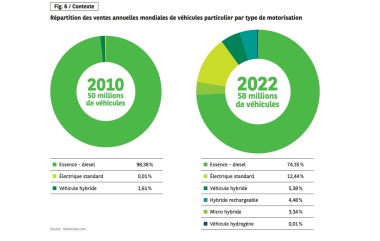

A more complex energy mix

This difficulty is also explained by a certain vagueness in terms of information destined for motorists, starting with the vast variety of engines available on vehicles today. If in the last thirteen years sales have increased by 20%, the energy mix has been completely turned around with the arrival of hybrid, micro-hybrid, rechargeable hybrid, electric and hydrogen vehicles. As a result, the petrol/diesel tandem has lost nearly 25 points in market share.

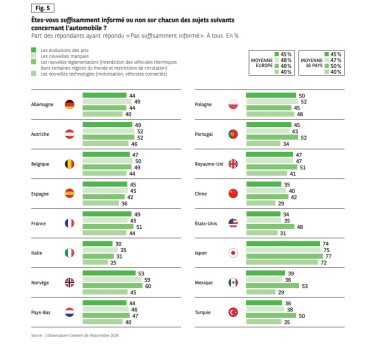

Unclear information

The lack of information expressed by motorists is also true when it comes to prices, car brands and regulations. Half of all respondents indicate a lack of information regarding the new regulations in relation to choice of engine and traffic regulations. This vagueness is particularly felt in Japan (77%) as well as in Norway (60%). Secondly, information on new brands causes issues for 48% of those surveyed (and up to 75% in Japan). The same proportion of motorists believe that they don’t have all the necessary data to hand about price developments (45%). And if information concerning technologies appears to be better communicated, four out of ten still consider themselves poorly informed on the subject.

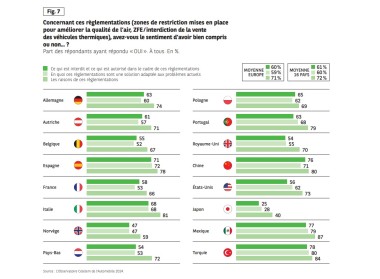

Low Emission Zone, it’s all a blur

When it comes to LEZ regulatory frameworks and traffic restrictions, the fog turns out to be even thicker. Frameworks are at best complex, at worst infinitely variable. The Cetelem Observatory calls them “regulatory chameleons”! And if more than 60% of people say they are aware of LEZs, only a third know precisely what they are! A similar proportion admit ignorance. Likewise, if 66% of those questioned think that it is a good measure, we must go to the countries where LEZs have been around the longest, to find a high proportion of those with a negative view (Belgium, France, Italy). Finally, for 80% of respondents, this type of measure appears unfair to the poorest households.

Are EVs really the magic solution?

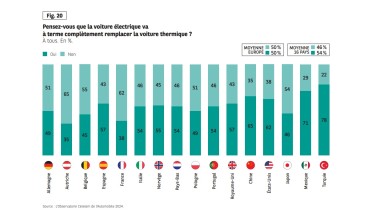

The Cetelem Observatory notes this year that, for the first time, electric vehicles lead in terms of purchase intention, with 32% for the sixteen countries studied, and 65% for China. If we add purchase intentions for hybrid vehicles (rechargeable or not) we are witnessing “a real shift in the market”, notes the Cetelem Observatory. The breakthrough in electric vehicles is therefore notable, especially since more than half of respondents consider that the EV will ultimately replace ICE vehicles. There are certainly significant disparities from one country to another; The Turks and the Mexicans seem convinced; the Belgians and Austrians appear much more reserved. But the internal combustion engine puts up resistance with purchase intention rates only a little lower. All the same, 50% of people do not want to switch to electric, considering it too expensive, 30% more compared to an equivalent ICE model. Other factors increase doubts such as the future cost of electricity, battery autonomy and recharging capacity. Only 54% of respondents in the sixteen countries (and 50% in Europe) consider that electric vehicles will ultimately completely replace ICE vehicles. A stubborn scepticism towards the much-vaunted solution for the future.

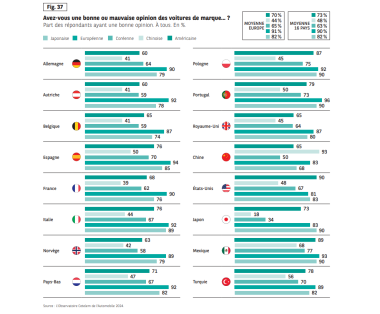

The latest Chinese manufacturers still have to build an image

Another interesting graphic shows us that, at a time of ecological transition, the new Chinese manufacturers who champion electric vehicles are leaving their domestic market and are now displaying global ambitions. But what perception do consumers have of them? Because they have been around longer European manufacturers score 90% favourable opinions and the Japanese (82%) and the Americans (73%) also have a good image. This is not yet the case for the Chinese brands when less than 50% surveyed say they have a good - 48% on average across the sixteen countries analysed. This is particularly the case in Japan, with only 18% of favourable opinions, but also in France at 39%.