Electrification is inevitable, but not universal

After the euphoria surrounding the transition to all-electric vehicles, the race towards decarbonisation has slowed down in 2024. This is due to the reality that consumers are still attached to their internal combustion engine cars. Nevertheless, the players in the aftermarket recognise that the change is inevitable, but it remains uncertain at what pace and in what proportion it will happen.

They are certain that the ICE engine will continue to dominate the automotive market for another two decades. This sentiment is even stronger after the apparent decline in European consumers’ enthusiasm for electric vehicles. The German and French markets have been dampened by the end of government subsidies for a vehicle that is still significantly more expensive than conventional ICE cars. “As an original equipment supplier to car manufacturers, we believed we could transition more swiftly to electric technologies. However, the market’s uncertainties have challenged this assumption. Currently, we are witnessing renewed opportunities in technologies associated with ICE engines, as manufacturers are requesting extensions for certain models,” Jacques Fils, from Aisin, explains. This poses a significant challenge for industry players, but the aftermarket is currently circumventing it.

Preparing to manage electric cars

According to a recent prospective study by Roland Berger, electric vehicles could account for between 64% and 71% of new vehicle sales in 2040. This figure will be complemented by 20% of hybrid vehicles. However, hydrogen and synthetic fuels will play a relatively minor role due to their low efficiency and high cost.

Neither euphoria nor denial prevails among our contacts, who are calmly preparing the partial transition to electric technologies. “Given the current buoyant cycle in after-sales, it is the right moment to prepare for the coexistence of these two technologies. Neglecting this preparation would leave room for competitors who will enter without the comprehensive knowledge required to manage the after-sales sector and its needs,” explains Philippe Colpron from ZF. There are chances to seize with the arrival of new Chinese players who will prefer forming partnerships with reliable equipment manufacturers and existing maintenance solutions instead of investing heavily in an unplanned after-sales service. Distributors are beginning to question the integration of the first ranges of spare parts released by their suppliers into their stock. However, Fotios Katsardis from Temot cautions against this move, emphasising the mismatch between interest and actual opportunities. “The market is so small that it will take several years for it to significantly contribute to distributors’ revenue. Additionally, the transition is not uniform, with some markets with high EV adoption being more receptive than others, particularly in regions where electrification is progressing more slowly.”

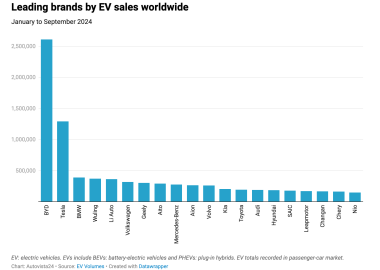

Chinese dominance

Given the current dominance of Chinese manufacturers in the electric vehicle market, it’s not just about questioning the relevance of covering this technology, but also about understanding their suppliers. “We’re working with our partners in the markets where Chinese expansion is most advanced to gain insights into the impact and support mechanisms in place. This includes identifying new suppliers and understanding their product sourcing processes. Because they will soon arrive in Europe. Chinese vehicles are gaining ground due to their competitive pricing compared to European vehicles,” Warren Espinoza from ATR International assures us, “they are part of the future, whether we like it or not”. However, it remains to be seen whether their suppliers will dedicate parts for Chinese vehicles to their catalogues, as some Tier 2 and 3 suppliers are already doing. If not, market players will know where to find the parts to meet the maintenance needs of the vehicles on the road.

It’s a practical approach, considering the Roland Berger projection that by 2040, Chinese vehicles will account for 15 to 20% of sales in Europe, 5 to 10% in North America, and 70 to 75% in China. This share could be reduced below 10% in Europe and 5% in the United States if Western manufacturers invest significantly in technology. Therefore, aftermarket players must address this issue to avoid being excluded from a significant portion of the vehicle parc.