Outlook: The aftermarket is essential for mobility

How is the global aftermarket evolving? The he global aftermarket is undergoing significant changes, influencing manufacturers. A progress report are presented by analysts from the Roland Berger consultancy and McKinsey.

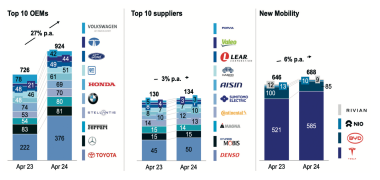

TOP 10 manufacturers and TOP 10 equipment manufacturers in 2024 market capitalization in billions of dollars and increase compared to 2023.

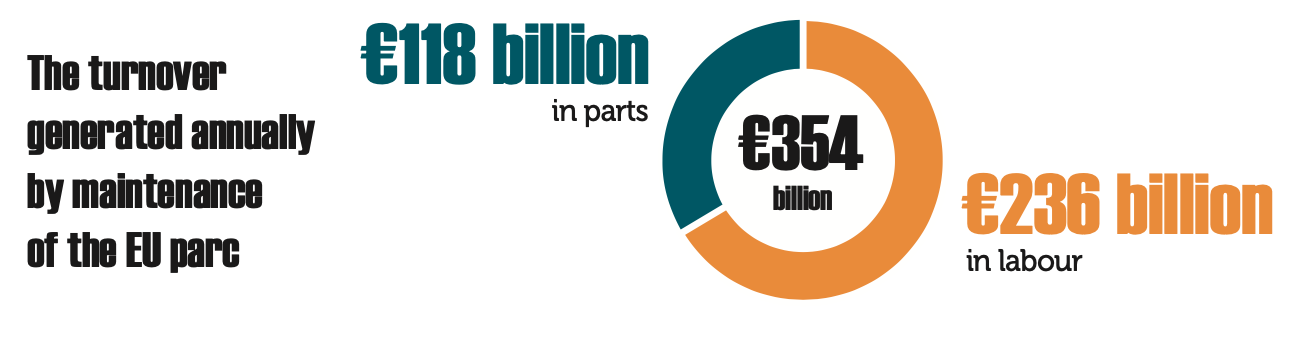

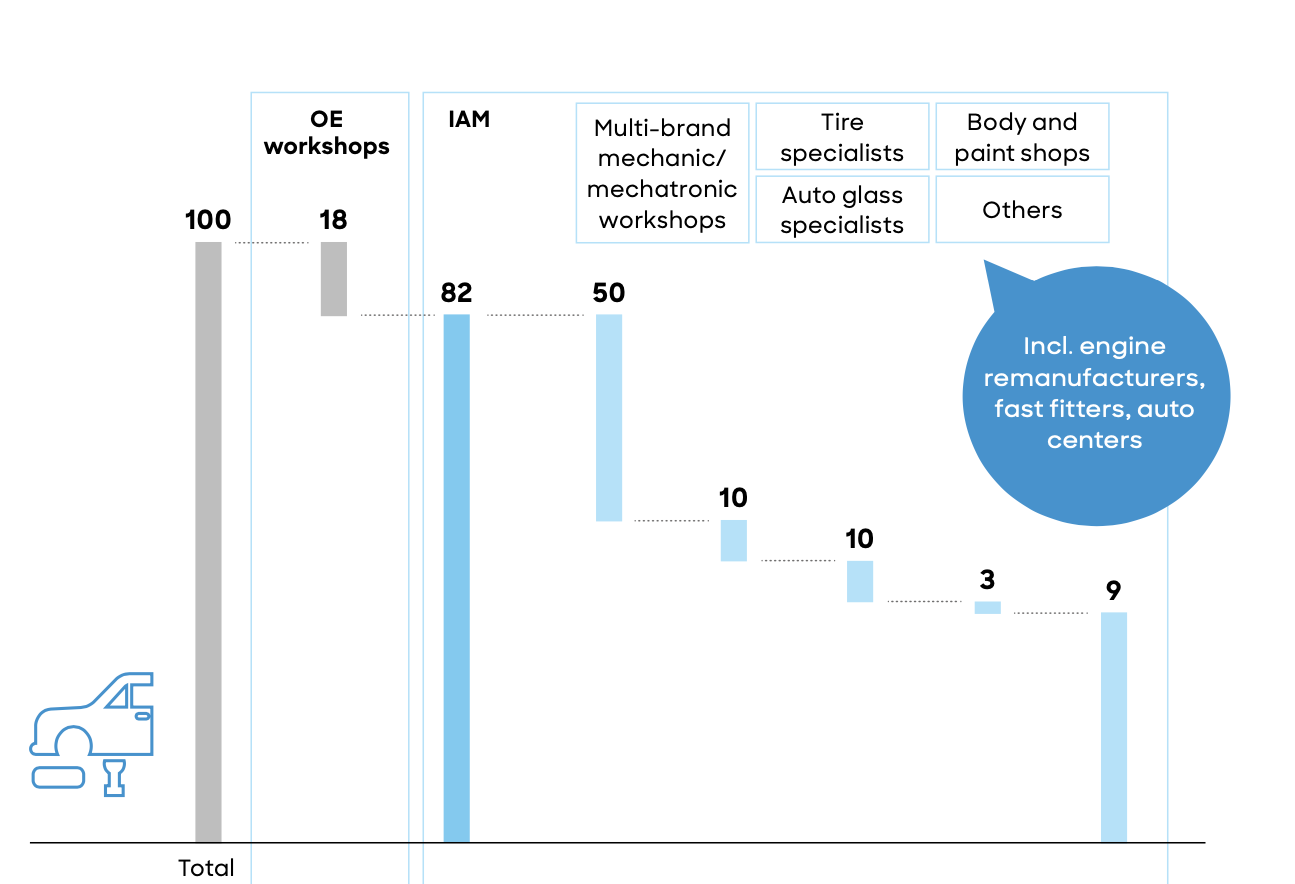

IAM dominates maintenance in Europe

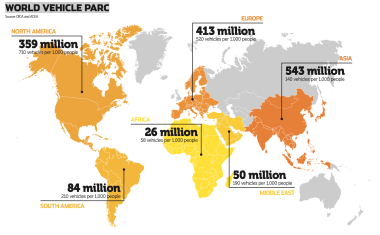

The independent spare parts sector is vital to ensuring mobility in the EU. With an average age of 12.3 years, six out of ten repairs are carried out in multi-brand workshops on the 280 million vehicles on the road in the European Union.

€500 billion

generated by the aftermarket worldwide, out of a total global automotive revenue of €3,000 billion. (Source: MF World Economic Database / Temot)

IAM represents the largest market share of total aftermarket sales: Parts and components business only, at consumer prices, excluding labour and VAT. Size of EU aftermarket (parts & components; OEM & IAM) [Billion EUR]

(source : Figiefa Roland Berger)

The IAM European network is a strength compared to OES

282,000 independent spare parts distributors and multi-brand workshops

54,000 manufacturer network workshops (OE workshops).

$91.4 billion

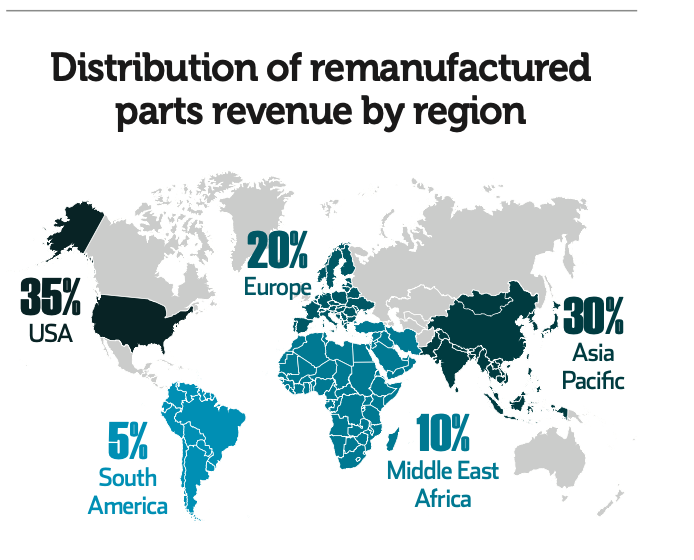

The value the global remanufacturing market could represent by 2030, compared to $65 billion in 2024 (Source: Research and Market)