Sustainability: CSR wins the favours of the IAM

With active regulations, a motivated ecosystem and labelled products, all the planets appear to be aligned to turn what was previously an abstract notion into reality. But much still has to be done.

"Four years ago, when we talked about sustainability... nobody understood us. Today, the leaders of major distribution groups know they have to take an interest in ESG (environmental, social and governance) issues. And that's true all over the world”, explains Antoine Soulier, co-founder and CEO of Inteliam, which assesses and supports global retailers in improving their performance. This awareness has been accelerated by the entry into force of the European CSRD (Corporate Sustainability Reporting Directive), which sets standards and obligations for non-financial reporting. “This regulation addresses the need for transparency and accountability, with the ultimate aim of getting companies to take ownership of the approach.” Adopted by automotive manufacturers and distributors alike, the approach is now spreading to their entire ecosystem.

A universal dawning

Although the process originated in Europe, it is also being taken up outside the European Union. Australia, for example, is about to roll out a CSRD-inspired approach. This regulatory obligation has helped to accelerate the movement, “with European players taking the lead, as we have seen from the 200 companies on four continents audited by Inteliam. However, we are also sensing a growing awareness of the need to go sustainable in other parts of the world."

ESG criteria in detail

This tool to assess how responsible companies are towards the environment and their ecosystem (employees, partners, subcontractors, customers) is founded on three pillars:

- Environmental: waste management, emissions reduction and environmental risk prevention.

- Social: accident prevention, staff training, respect for employee rights and the subcontracting chain, social dialogue.

- Governance, to verify the independence of the board of directors, the management structure and the presence of an audit committee.

From words to actions

Nevertheless, while measuring their environmental footprint (and carbon footprint in particular) is a noble accomplishment, companies must then translate their painstakingly collected ESG report data… into action! “This is all the more fundamental as all partners will eventually demand transparency on carbon footprints." And for distributors, the first area for improvement is logistics. Thus, Parts Holding Europe, one of the Top 4 European distributors, officially embraced sustainability in 2024 by recruiting a specialist on the subject and launching a plan to decarbonize its logistics sites, focusing on energy savings and efficiency (heating, lighting, insulation and fleet). “As a good corporate citizen, we implement concrete, pragmatic plans. They have the advantage of coinciding with technological developments, the company's economic interests and environmental protection”, explains Jeremy de Brabant, Group Managing Director. He adds that Poland's Inter Cars (one of Europe’s top 3), Scandinavia's Meko and even LKQ “have made this commitment a key differentiator.”

Community-based initiatives

To go even further, ITG Nexus Automotive has placed sustainability at the heart of its strategy, notably with the launch of its “Climate Day”, consisting of setting up joint workgroups between members and suppliers to bring out concrete solutions and sustainable best practices. The same goal is being pursued on a broader scale with the FAAS (Forum on Automotive Aftermarket Sustainability), launched in 2023 by Clepa and Figiefa, which already has 200 members (OEMs, automakers, ITGs, distribution groups, etc.). "And if we add the rise of circular economy parts, and portfolios beginning to integrate ‘green’ products and services, we can see a growing number of virtuous approaches in terms of environmental protection. This is good news... but there's still a long way to go yet,” says Antoine Soulier.

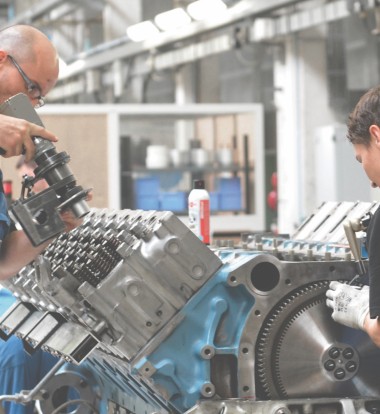

Remanufacturing: sustainable and circular

Generating $70 billion in sales worldwide, the remanufactured parts segment is expected to surpass $112 billion by 2030. While eminently sustainable, “reman” parts still suffer from a lack of visibility in some parts of the world, as well as regulatory obstacles and the complexity of the supply chain. As a result, they are struggling to find their place in international trade. "Remanufacturing is based on a short loop approach. We export a few reconditioned products, such as power-assisted steering systems to Poland. Deposit return (the return of old materials), which is vital to our industry, weighs down on the export process and costs, so they’re not always the most competitive option. We also observe a lack of maturity on the subject among distributors outside Europe,” explains Gaëlle Maillard, chief executive of the SPMI group, a supplier of reman products. The same is true at French remanufacturer Depa International, which has opened an office in Germany and occasionally exports to Italy. "What our customers want most is a quality product, at the right price and with the right availability. If it's circular, then so much the better,” says Luc Avisse, Depa's managing director. Nonetheless, the sustainable aspect of auto parts is being actively promoted by automakers, as well as equipment manufacturers such as Valeo and Bosch, historically established in the sector. Could they bring a boost?

Sur le même sujet