[Atlas] Online parts spin their Web

The auto parts industry has not escaped the trend: lockdowns and travel restrictions have given e-commerce a major boost.

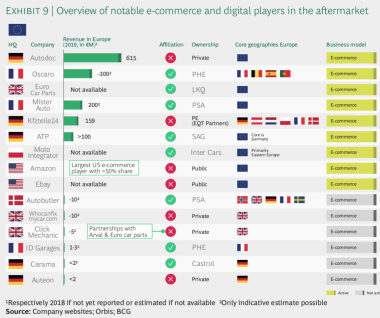

Whether general marketplaces or specialist platforms: whatever their business model, online spare parts vendors are riding a wave of growth and expansion into new countries. It has to be said that - excluding the booster effect of the pandemic and its lockdowns (+37.5% for Autodoc!) - the double-digit growth of the early days is now a thing of the past. The growth drivers are therefore to be found in international development. The French company Oscaro (owned by Parts Holding Europe ) has just launched in Germany. But with only five countries covered, this European number 2 in online parts (€300m turnover) is a long way behind the deployment champions like Germany’s Delticom , which operates in 34 countries with 76 sites, or Europe’s leader in terms of turnover, Autodoc , which has an impressive network of 269 sites for 27 markets served, according to a study carried out by the experts at Wolk AfterSales*.

Market share expected to reach 30% in 2030

With regard to marketplaces, eBay lea ds the way with 111 e-merchants listed on the platform compared to less than 30 for Amazon . By country, the dynamics are the most remarkable in Russia, with the best traffic observed among the 40 countries studied (source: Amz). Great Britain and France are on the second and third steps of the podium, followed by Germany, Spain and Italy. But there can be no doubt that e-commerce for BtoC parts – and increasingly for BtoB parts – is the business of the future. Although it does not exceed 5% of the overall European parts market, it is estimated that by the end of the decade this share will have doubled, or even risen to 30% if services are added. In the United States, owing to Covid, e-commerce grew by 15% last year, while the overall market fell by 5%, according to consultant Alexander Gruzdev. According to the research institute Market Research Future, the global automotive e-commerce market is expected to grow by almost 25% between 2022 and 2030.

Serious competition!

This means that the market will have to increasingly reckon with e-commerce players in the parts sector, but also service aggregators, armed with their capital of data, who will nevertheless have to continue to add service bricks and position themselves to attract fleets. And Tier 1 equipment manufacturers will no longer be able to snub these online vendors. These two factors combined make e-commerce both a relevant opportunity and a threat for wholesalers, as new challengers will quickly come to challenge the ecosystem, both traditional distributors and e-tailers. l

* The study covers a panel of 507 online parts and tyre specialists with at least one BtoC portal, encompassing 40 countries with a total of 1,100 sites listed.