Germany : Wanted parts… and workers to fit them !

In 2022, the German market had to deal with several issues: firstly inflation, which is expected to land at 10% for the year, and the explosion in energy prices.

The next problem was parts prices. “Between August 2021 and August 2022, car makers increased their prices by an average of 8%”, says Jörg Asmussen, the CEO of the German Insurance Association GDV. Between 2013 – the date that surveys began – and 2022, manufacturers thus applied hikes of 55% on average, while the consumer price index rose by “only” 22%. Outcome: the average value of a claim has also increased from €2,400 in 2013 to €3,375 this year.

Alternatives

“There is still acute pressure on spare parts supply chains [due as much to the Russia-Ukraine conflict as to the Chinese zero-Covid policy – Ed.]”, also observes Sebastian Heitfeld, director of GiPA Germany. While generally it is only specific and isolated SKUs that are hit, these can nonetheless take months to finally arrive! Some distributors have anticipated the problem by overstocking. All distribution players were obliged to search far and wide to find alternatives, in Germany and elsewhere. To cater to the needs of motorists, workshops also activated the levers of used, reconditioned and repaired parts. This in fact is “a path taken by the entire sector at a time when the priority goal is zero carbon”, notes Sebastian Heitfeld. These issues are exacerbated by “labour shortages in the auto industry in general, and in workshops more specifically, which are becoming problematic”, emphasises the director of GiPA Germany.

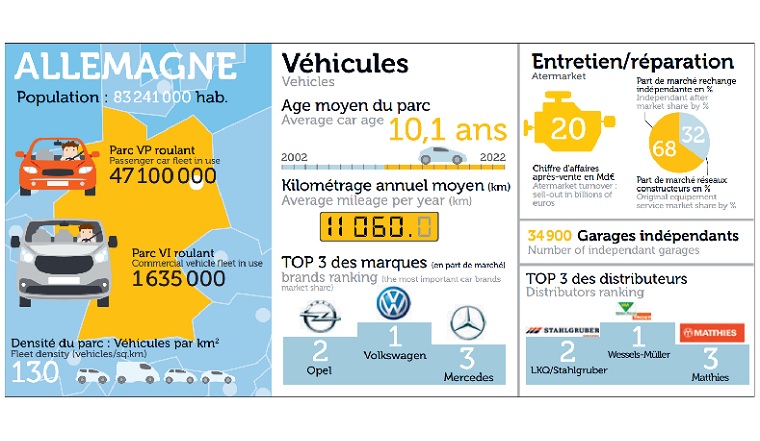

It nonetheless remains that the aftermarket is still enjoying healthy business, with the fleet reaching 47.1 million vehicles, surpassing the 10-year average age bar, and with new vehicle sales that are down by 2.4% in the first 11 months of the year.

Spare parts sales : car manufacturers in search of new sales channels

Spare parts are becoming ever more lucrative for car manufacurers as new vehicle sales fall off. However, with looser network coverage by approved repair networks, to keep business afloat, manufacturers are now targeting independent workshops as new outlets for their OE parts. The Cologne-based automotive consultancy BBE looked closer at this new trend by surveying 100 independent outfits. The first finding: 75% of workshops surveyed have observed efforts by car makers to win them over and turn them into clients. Volkswagen appears to be the most active, according to more than half of the independents surveyed. Next on the list is Mercedes, who has already approached 40% of the sample, then BMW (30% of respondents). Importers seem to be relatively conservative on this score. The search for new sales channels also applies to dealers, according to BBE : 42% of this population declared that they were actively trying to sell spare parts to independent garages.

AAG reinforces its lines

The European subsidiary of GPC continued its spending spree in Germany. Thus, AAG, recently announced plans to acquire Knoll and Transport + Logistik Schleiz. With 18 distribution centres, the family-owned company headquartered in Bayreuth operates in Bavaria, Berlin, Brandenburg, Saxony and Thuringia. With a team of 560 people, the distributor reported €107 million turnover in 2021. Subject to the approval of monopolies and mergers authorities, the acquisition will reinforce the positions of AAG Germany which last year reported €400 million turnover across 71 locations. It is also the opportunity to extend its traditionally western geographical footprint further east, in particular with Berlin. As a reminder, the German entity of the group, founded in 2005 and headed by Fabian Roberg, brings together all the companies owned by AAG: Coler, Busch and Henning.

Carat joined by Birner

In early 2023, the Austrian spare parts distribution leader Birner GmbH will be joining the Carat group as a shareholder. A family-owned company founded more than 90 years ago, Birner has 26 branches in its domestic market, and employs 560 people. The distributor works from a central warehouse stocking 600,000 articles, and will now support its goods and logistics services with those of Carat, available from its two warehouses : the adCARGO central warehouse in Castrop-Rauxel, and the new logistics location ad-CARGO regional warehouse south in Nürnberg, which will start at the beginning of 2023. With the entry of Birner, the Carat Group has achieved another milestone in its strategy for growth and expansion into other European countries, by extending into the Austrian market. Also worth noting that in early 2023 the group is to launch a new workshop concept christened Moon, aimed at enabling repairers to adapt to both technological developments– and the investment in equipment and training that they entail – and changes in consumer behaviour (digitalisation, shared mobility, etc.).

To read the french version : Cherche pièces... et poseurs pour les monter!