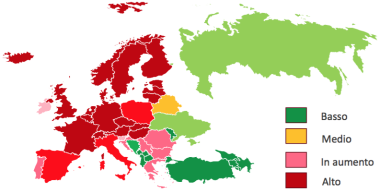

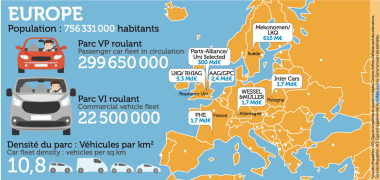

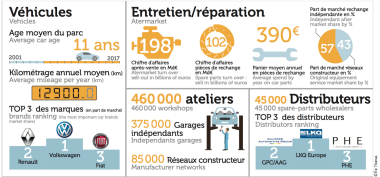

An overall after-sales business worth nearly €200 billion, of which three-quarters is in spare parts, that’s €142 billion (€120 billion in mechanical parts and €22 billion in bodywork) to be shared between manufacturers’ workshops and 45,000 distributors of independent parts. More precisely, it is on a battleground of €102 billion (wholesales in mechanical and bodywork) that the European spare parts business is being fought. But which Europe? Because between the mature countries of the West where growth fluctuates between plus or minus 2% every year and those in the East where so much remains to be done "and Poland is the front runner" continues Christophe Espine (NTN-SNR), the key actors must learn to be agile. Russia could also end up being the Eldorado the leaders of IAM are hoping for. But we must accept the risks inherent in its chronic instability, which does not please potential financial investors.

Be in tune with workshops"The Eastern European countries are growing strongly, but I also note an upswing in Italy and Spain, after a few years of decline between 2014 and 2016. Since then, these two countries are recovering. There are some weaknesses of their economies, but I do not see any dramas on the horizon" says Eric Schuler (Valeo Service). As for the UK, in the middle of the Brexit crisis, the only thing to do is to wait because “the market will adapt, it will not disappear”. For Markus Wittig (ZF Aftermarket) "the question is not are there growth countries and the others. Because in some markets, some of your product lines will sell very well while others will not. Having a good level of penetration in a country therefore means having an offer in line with the needs of garage workshops. And the needs can be significantly different from one country to another."

Europe not so oldIn the same way that a dual presence in IAM and OES makes it possible to compensate for short-term economic activity of one or the other, suppliers are looking to conquer new markets to guard against European uncertainties. China is in their sights. "While we Europeans are looking for levers elsewhere, Americans – equipment manufacturers and distributors – have made breakthroughs in Europe to find new sources of growth that can offset the tensions in their domestic market. It is very interesting to see they come to Old Europe to find recovery. It is proof that the Old Continent is still dynamic with good growth prospects" concludes Françoise Blais (Sogefi).Caroline Ridet