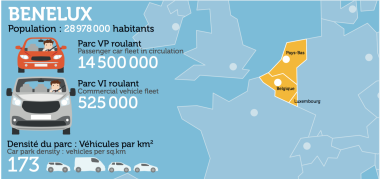

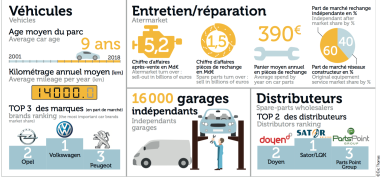

Through Doyen*, Parts Holding Europe acquired Geevers Auto Parts B.V. in spring 2018. Established in the Netherlands, the organisation is the leading independent retailer of car body parts in the accident and repair markets in the Netherlands, Belgium and Luxembourg. Generating average growth of more than 10% per year, the firm (and its 200 employees) reported €67 million euros of turnover in 2017. In addition to its Dutch central platform in Veldhoven, Geveers stocks more than 100,000 parts, either manufacturers’ originals of equivalent quality, for 35 vehicle makes, delivering them throughout the Benelux countries in 24 hours. With Cora in France and Geveers in Benelux, PHE is reinforcing its geographical position in Western Europe and becoming the leading independent retailer of body parts in Europe, according to the group. There was another acquisition in the autumn for Doyen when it bought Verviers Freins, one of its Belgian members, a multi-brand and multi-activity distributors and an active member of API (running 20 1,2,3 Autoservice garages). Established in the Liège region and in the eastern Belgian cantons, Verviers Freins has eight sales outlets and generated €21 million in 2017. PHE is evidently continuing to expand in Belgium to mount a challenge to the unrivalled LKQ Europe. This is a battle of the giants for an overall replacement parts markets ten times smaller than in Germany… but also a way for the French leader of opening up an eastern front.* Doyen reports €200 million turnover and has 168 distributors in Belgium, the Netherlands, Luxembourg and France.Caroline Ridet