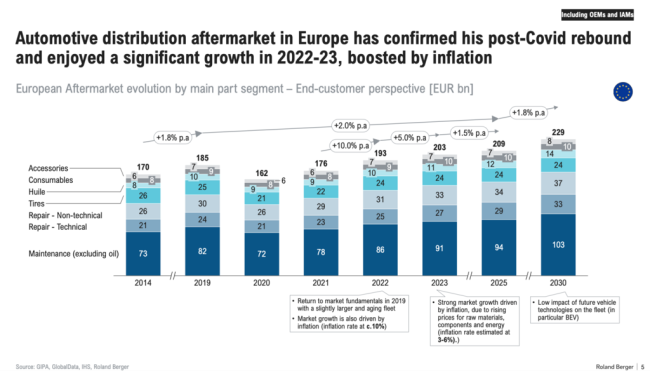

Outlook: The aftermarket, the realm of resilience

How is the global aftermarket evolving? With the race for energy transition and the emergence of new players among automotive parts manufacturers, the global aftermarket is undergoing significant changes, influencing manufacturers. A progress report and a vision for 2035 are presented by analysts from the Roland Berger consultancy and the Xerfi institute.

2023 automotive supplier classification

In a sign of the times, it is a Chinese company - Contemporary Amperex China Technology - that has posted the most remarkable performance: 79.2% growth in 2022 compared with 2017, for sales of €33.4 billion. This exponential growth by CACT heralds the role that Chinese parts will play in the future. For the time being, however, the prize for the highest volume of business remains with Bosch, with sales of €52.6 billion in 2022. For this 2023 edition of the classification published every year by Roland Berger, 100 companies were analysed, with the largest number still being from Japan (24 companies), followed by Europe (23) and the US tied with China on 16 companies each. The study notes that since 2017, Chinese suppliers have been gathering momentum in terms of both numbers and business, with the 16 Chinese companies included accounting for 18% of sales in the global Top 100. (Roland Berger)

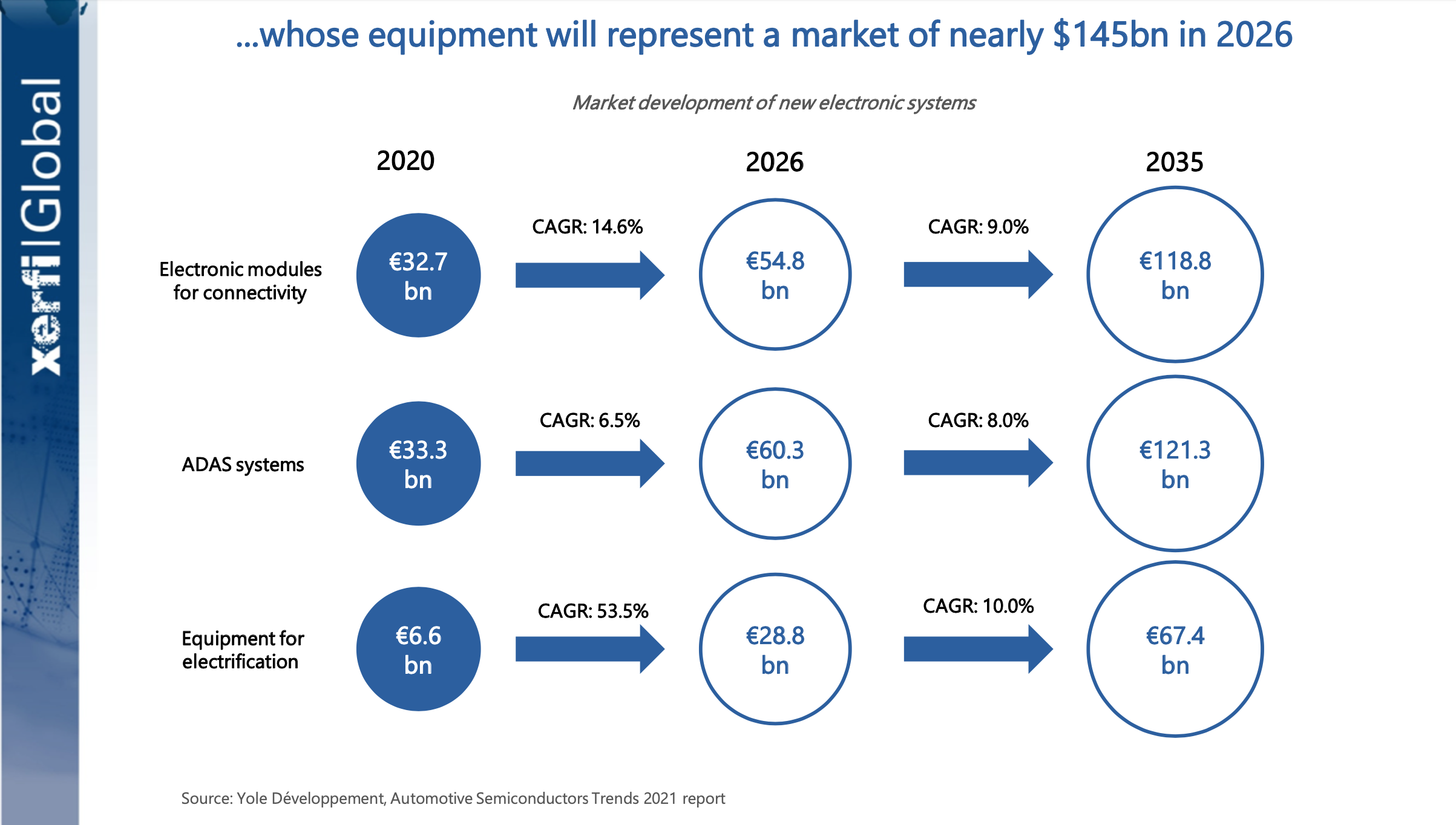

The weight of connectivity and electrification technologies

The onboard electronic equipment market will be worth nearly €145 billion in 2026. (source: Xerfi Global – December 2021)

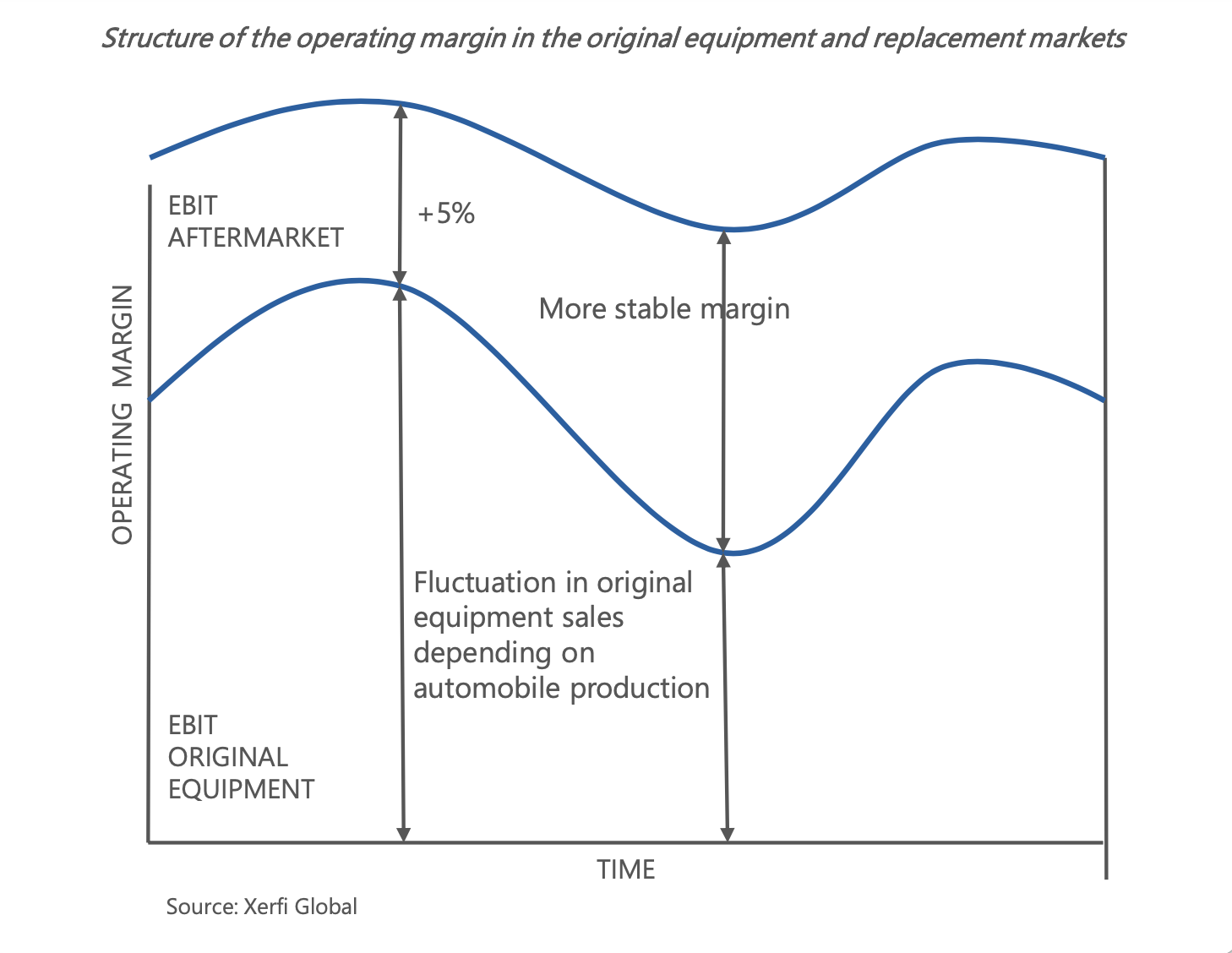

The aftermarket more profitable than original equipment

Sales aimed at the replacement market make up a marginal share of the business of automotive equipment suppliers (5-15%) but pay better. In addition to not being very cyclical, aftersales activity is essential to maintain consumers’ brand loyalty, and a key factor for its image. (Xerfi)

90 $ billion in 2028: the potential worth of the global remanufacturing market, compared with $59 billion in 2022 (source: Research and Markets).

Variation in aftermarket

The Xerfi Global report (December 2021) anticipates the global parts market to be worth $800 billion (retail price) by 2027. This figure drops to $603 billion for distributor selling prices, which is 38% higher than in 2022. The expansion of the global vehicle parc and its ageing will therefore support business. In parallel, the growing proportion of advanced components and technologies (ADAS, connectivity, telematics, infotainment, etc.) in vehicles will increase the number of components and drive prices higher.

69 $ billion: the value of the global online parts market in 2022, set to rise to $258 billion by 2032. (source: Global Market Insights).

Retrouvez la version en Français : Prospective : l’aftermarket ou le royaume de la résilience