Image

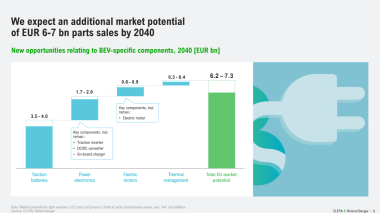

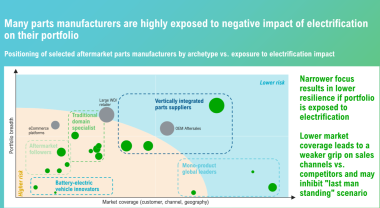

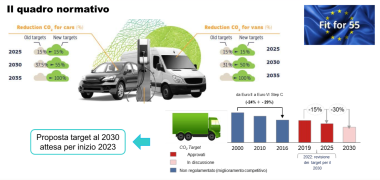

Fit for 55: What is the after-sales impact of this package of measures that are designed to reduce by 55% the European Union's CO2 emissions by 2030, while maintaining industrial competitiveness? This vast topic began during the last edition of the Italian Parts Aftermarket Congress (DB Information group). The economic consequences are numerous and even fatal for those who have not anticipated this ecological groundswell which is already affecting IAM. The sector still has all its cards to play to achieve a successful conversion, but under certain conditions.