[Atlas] An evolving market: place your bets for 2030

The chips are down for the automotive world of the coming decade. The fleet on the road should expand by 16%, while the aftersales market could potentially grow by 20% worldwide. But players will have to reinvent themselves if they want to avoid missing out on this fast-evolving aftersales business.

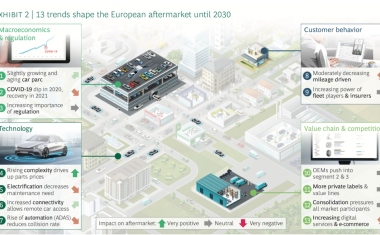

Between now and 2030, the European aftermarket – a solid ecosystem offering healthy margins, steady growth and a stable environment – is set to change considerably. The main reasons: a vehicle fleet gradually converting to electric, and an accelerated change in consumer habits. This is what emerges from a collaborative foresight study by the Boston Consulting Group , Clepa and Wolk After Sales Experts .

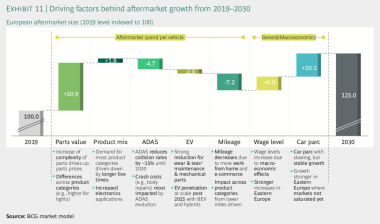

The challenges ahead are not new: digitalisation of the sector, vehicle electrification and mounting competition from all distribution channels, including new digital players... A sense of urgency to transform that is unanimously shared by the sector’s observers. The annual growth of the aftermarket, regularly standing at 2% since 2011 and forecast as such until 2025, is expected to drop below 1% over the last five years of the decade.

Growth of more or less 2% over 10 years

This is likely to fuel the war of positions between the independent aftermarket and vehicle manufacturers. The latter will likely reclaim control by harnessing data from connectivity, with forecast growth of around 3.5% per yearbetween 2025 and 2030, ultimately garnering around 40% of the market, leaving 60% of business to the independent aftermarket.

Fewer, dearer parts

While analysts anticipate a decline in parts sales volume as electrification progresses, this will be partly offset by an increase in their value and in maintenance costs due to increasing technical complexity. In other words, while the pie will shrink, it will become more valuable. However, the effect will be mitigated by the impact of ADAS, which will tend to depress the market, particularly from 2025 onwards, by reducing the number of accidents and their severity by 15% compared to 2019 levels.

But also change nature

Nevertheless, this electrification will eventually change the basket of automotive components and thus disrupt the entire supply chain, according to a McKinsey report released in September 2021 (see chart).

Electrification components (batteries, detection sensors, LiDAR, radar and other cameras) will account for around 52% of the total size of the market by 2030. In contrast, the volumes of components dedicated to combustion vehicles (engine, fuel injection systems), which are now largely dominant, will have fallen by half compared to 2019, representing only 11% of sales. Connectivity – 50% of the fleet by 2030 – will also change the service game. The possibilities of remote diagnosis and preventive maintenance services will be beneficial – at least initially – to vehicle manufacturers and their network(s). Except that the search for a better cost of ownership will eventually generate opportunities for multi-brand networks, at least those capable of providing an integrated offering and sufficient national or even cross-border coverage. This is a race that the leaders of independent distribution have been engaged in for several years. In this landscape described by the BCG-Clepa-Wolk team, consolidated wholesalers will be under pressure to reduce logistics costs.

Digital at the heart of transformations

Increasingly, e-commerce providers will also have to be reckoned with, since their market share is expected to double (from 5 to 10% of total parts sales) by 2030. The same is true for «service aggregators», which generate traffic, but which will have to add technological building blocks, particularly to sharpen their understanding of needs and attract fleets.

Caroline Ridet

Worldwide: anticipations of a fleet of 1.6 billion PV + LCV

In 2021, there were just over 1.4 billion vehicles (passenger cars and light commercial vehicles) on the road worldwide. By 2030, this global fleet will have grown by 16% to 1.6 billion units, but growth will be uneven across regions. The emerging markets alone will account for the lion’s share of this increase. China will obviously lead the way, since its fleet is set to grow by at least 5% per year, whereas continental Europe, North America and even South America will only grow by about one point per year... Africa, the Middle East and India will only do slightly better: between +1.5% and +2% per year.

Electrification and its negative impact on aftersales volumes (it is estimated that a battery electric vehicle has 30% less aftersales requirements) will be significant in China (30% of the electrified fleet in 2030) and in Europe (22%). But the phenomenon will be less significant on a global scale. The total number of hybrid, plug-in hybrid and battery electric vehicles will rise from 2% (in 2019) to 4% of the world fleet in 2025... and to "only" 6% in 2030. That’s around a hundred million vehicles, compared to the 1.5 billion vehicles that will still totally rely on a combustion engine.

Jean-Marc Pierret