Inter Cars: A leap into the top 3

Despite the conflicts raging on its country’s very borders, the Polish leader should end 2022 by reaching and even surpassing the €3 Bn turnover mark. This should knock Alliance Automotive Group off the second highest step of the European podium.

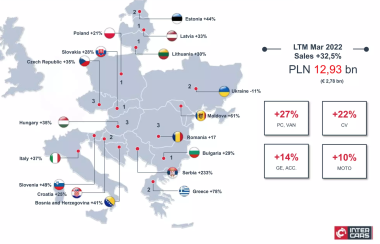

In the first 11 months of the year, Inter Car’s sales grew by 23% compared with the same period in 2021, which itself had closed on a revenue figure of €2.8 Bn. The 2022 performance is of course driven by the activity generated on its domestic market (+19.1%) which makes up 42% of its turnover. But it is also in its export business – 58% of sales and +2 points compared with 2021 – that the Polish firm set the meters whirring with 27.2% growth. For 22 years now, Inter Cars has turned to its Central European neighbours to generate its growth. And even the Russia-Ukraine conflict has not destabilised – it has even been a growth lever for – the group which announces impertinent performances (see graph) as far as Germany (+61% over nine months) or the United Kingdom (+45%). None- theless, the distributor saw its logistics hub in Kyiv destroyed, without it however interrupting business: only one of its 38 local offices was forced to shut. As a result, Inter Cars Ukraine (5% of the group’s overall sales) “only” lost 25% of its business in 2022 as against 2021.

The advantageous franchise model

Supporting this uninterrupted growth we can find the business model based on a “franchise” of local distributors (excluding in Poland) who buy from Inter Cars, but also major logistical investments made since its creation in the 1990s.

Today, Inter Cars covers 21 countries and has 11 warehouses in Poland, 10 in its neighbouring countries, and 600 owned sites – including 240 in Poland – and 300 integrated garages. This network coverage, built up over the years, has been conveniently reinforced by the digitalisation of processes.

Digital tech, the new cause

The pandemic and supply chain interruptions prompted the company to accelerate its investment in its digital solutions, notably its Motointegrator platform (nearly 20,000 registered garages) to gain in flexibility. “IT is becoming an increasingly crucial factor for Inter Cars. It is the only department in the company whose budget is allowed to grow faster than sales, because thanks to IT, we can plan and act optimally”, said Maciej Oleksowicz, Inter Cars’ board chairman, at the end of 2021.

And while around ten branches were slated for opening in 2022, the strategy deployed by the young chairman is rather to reinforce the group’s position to assume a leadership role in all the countries in which it is established. Because he strongly believes that to be able one day to knock the two big European leaders off their pedestal, he must capitalise on his trump card: consistent deployment, integrated block by block, a far cry from the headline-grabbing merger and acquisition deals.

Lire la version française : Inter Cars : Ascension dans le Top 3 européen