ITGs: New times and new directions

The six International Trading Groups (ITGs) that oversee traditional parts distribution are powerful. But structural and cyclical pressures are inevitably leading them to change their business models.

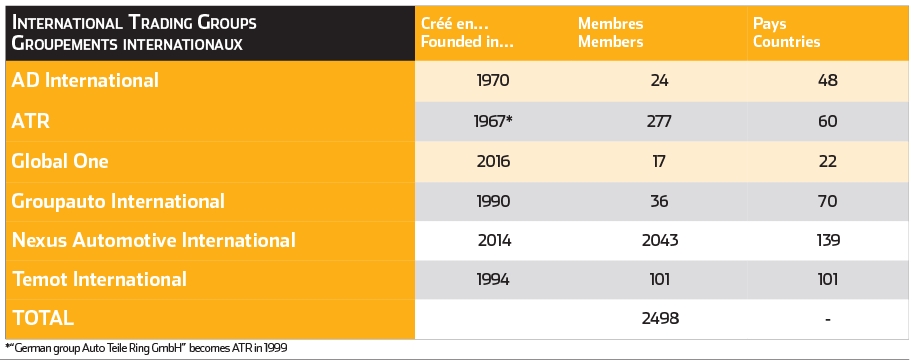

AD International, ATR, Global One, Groupauto International, Nexus Automotive International and Temot International are the six ITGs that reign over the global independent parts distribution. Together they represent, according to our 2021 estimates, a business of more than €110 billion, made by their members and/or distributor shareholders. Competing with them are the parts and service divisions of the car manufacturers who, although jealous of their numbers, greatly exceed them.

Historically, the first ITGs placed themselves alongside their parts suppliers who, from merger to merger beginning in the 70s and 80s, rose to continental and then global level. As federations these ITGs have become comfortable spaces for regular meetings. They exchange information about upcoming trends, think about the future of the aftermarket, imagine concepts, settle conflicts and propose jobs.

However, the aggregate of their turnover should not be confused with the aggregate figure of all their members’ balance sheets. The ITGs collect on average 2% of the purchase price of the “preferred” and other “listed” suppliers that they reference, to which are added any marketing contributions. This means that they collect between €50 and €200 million depending on their size, but they do not live off this as they distribute most of it to their members.

A variety of purposes

Not all have the same operating methods in terms of shareholding or the same pur- pose. The two most recent examples are significant in this respect. Global One was launched by the German Wessels+Müller in 2016 when it was obliged by competition authorities to leave ATR. This was one way to regain the 2% lost. Conversely, the emergence of Nexus in 2014 can be seen as an initiative combining modernisation and opening up the “business” to retail and pure-players. Nexus skilfully supported its initial development in regions outside Europe, where the other ITGs had recruited little or no members.

Whether it be the launch of the first ITGs with ATR in 1967 and ADI in 1970, or of the two most recent – Nexus and Global One – they remain upstream of the strategies of what is known as traditional parts distribution. And above all, their purchasing strategies govern this sector.

Times are changing

ITGs may not be experiencing an existential crisis, but they are confronted with new pressures and some tensions. The parts supplier members see many advantages in being invited and celebrated regularly but are increasingly wondering about the interest of accepting pressure on prices from these “heads of heads of groups”.

Because the economic situation is not helping premium parts manufacturers either. They are under other enormous pressures on the OE side car. Manufacturers have refused them the increases which would allow them to cushion the rise in raw materials and energy. Or to finance their redeployment to convert to electrical power, a move that the auto industry is undergoing in general and the parts manufacturers, the innovators of new technologies, in particular.

The concentration effect

Parts manufacturers are also annoyed to see that the ITGs, always looking for more sources of finance, tarnish their historical status of “preferred supplier” by offering competitors less capable than them the same advantage of recommendation. Here they have long found that the promises of volumes made by the ITGs diminish as they descend into the national structures, then to the local distributors, all logically jealous of their own strategies. Especially since the major groups such as LKQ, Alliance/ GPC and PHE are not to be outdone when it comes to purchasing requirements. And they keep the promises of volume in exchange for efforts made by their suppliers.

Wait and see

The emergence of these groups ranging from €2 to €5 billion in turnover in Europe (and over €20 billion in the world with GPC) also came to underline the difficulty the ITGs have in managing needs between the smallest and the largest of their members. Because these giants are still members of the ITG. LKQ is still with ATR, PHE with AD International and Alliance Automotive Group with Groupauto International.

Why do these giants of distribution remain members of ITGs which, in many respects, are less powerful than them? They could concentrate their purchases with even more discipline and obtain excellent purchasing conditions on their own? Firstly, because a large part of the 2% collected by the ITG which is returned to them is always good to have. Perhaps also because there is no better vantage point for anyone who wants to identify and seize growth opportunities.

The ITGs still have a bright future. They are the first to know that the inertia of the vehicle fleet never leads to rapid change. But they must also be aware that the time of the “collector’s bonus" is over and that their business model will inevitably have to evolve.

Lire la version française : Groupements internationaux : vers des temps et des vents nouveaux