Trading groups: suppliers measure up against ITGs and IWDs

International trading groups (ITGs) and international warehouse distributors (IWGs) are promising parts suppliers ever higher consolidated sales. But is the sometimes uncertain destination worth the price of the ticket? Take a journey to the centre of parts supplier secrets.

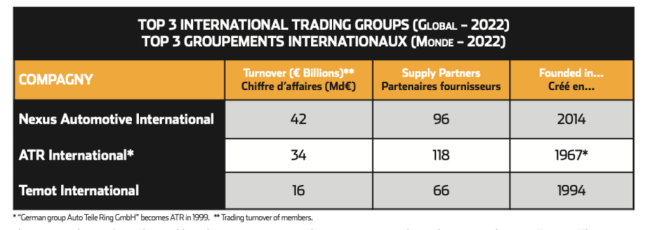

In 1967, Europe was the setting for the establishment of ATR International, the first international trading group (ITG). What a pioneering vision in a world that was still vast and segmented, particularly for spare parts distributors and equipment manufacturers. While it may have had high ambitions, ATR would surely never have bet that 56 years later it would cover six continents, federate 286 distributors in 62 countries and bring more than 100 OEM partners on board. But today, although it is not commonplace, it has at least become easier.

However, there are only seven ITGs : Nexus, ATR, Temot, GAI, ADI, Global One to which is added Amerigo International, created in 2018. This latest addition generates €800 million in turnover via 48 members spread across 4 continents and 25 countries. Among the top 3, Germany’s Temot International took just 30 years to cover 106 countries on five continents. Nexus Automotive International took just 10 years to break into 131 countries and post aggregate sales of €42 billion. Together, these three leaders are sailing towards €100 billion, and the 6 ITGs have already surpassed that figure...

How do they make a living? By charging their listed suppliers 1.5% to 2.5% of the turnover generated with their distributor members, who benefit from better pur-chasing conditions from the said listed partners.

IWD: Big(ger) is beautiful

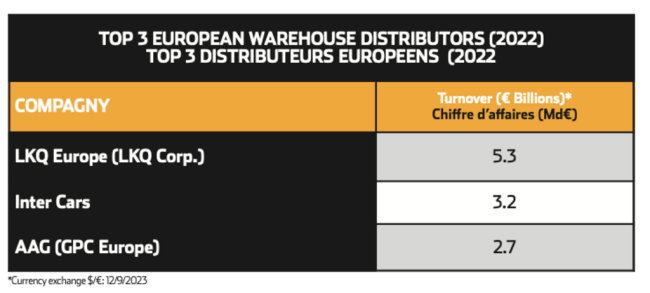

There is also a new breed of distributors who are also keen to expand internationally: International Warehouse Distributors (IWDs). They are growing in number and power: LKQ Europe, Alliance Automotive Group, Inter Cars, Parts Holding Europe, WM and SAG, to name but a few.

In Europe, it was LKQ Corp. that set the trend by acquiring Euro Car Parts in 2011. Twelve years later, after a flurry of takeovers, it was worth €5.3 billion in 2022 with LKQ Europe and almost €12 billion worldwide. In 2017, the North American behemoth GPC followed suit by acquiring Alliance Automotive Group in Europe (€2.7 billion of the almost €21 billion worldwide). And now Poland’s Inter Cars has already reached €3.2 billion by spreading its quasi-franchise strategy across several European countries...

Why are IWDs still members of ITGs?

Of course, all these groups are members of one of the seven ITGs. And they too demand premiums from their purchasing consolidations, which in turn squeeze the margins of equipment suppliers. It would be an exaggeration to say that these suppliers are happy with these multiple levies added to the volume rebates they already pay locally.

But to do without them would be risky, if not impossible. ITGs open doors internationally; upsetting them could shut them here and there. As for the IWDs, through the discipline of their acquisitions that have become subsidiaries, they are in a position to promise much more precise sales volumes than an ITG. To simplify things, we could use the very graphic image of one equipment supplier: an ITG is an assembly of autonomous property owners, with each of whom you can only hope to reach a compromise without ever falling out with their representative; the IWD, on the other hand, is the owner of the whole building. It can therefore decide what happens or doesn’t happen in each flat...

So why do IWDs remain members of the ITGs when they could demand and obtain, of their own accord, the 1 to 2.5 percent of commission? Because an ITG gives them a global vision that opens up strategic insights and access to the entire ecosystem. And above all, because it’s the best place to identify the next acquisitions...

A varied set of strategies

Equipment suppliers sometimes lose their bearings among the various remuneration approaches put in place by the IWDs. Some, like LKQ, have moved towards a reduction in the number of suppliers, with a tendering process based on a single European price. But this is still wishful thinking: first, market conditions need to be harmonised across Europe. This is certainly the case in the USA, but a total non-starter in Europe. The UK market is the cheapest in Europe, while the German and Swiss markets are the most expensive; distribution formats remain highly heterogeneous, intermediaries are disparate and suppliers’ market shares vary significantly...

Others, such as AAG, have sought to align off-invoice conditions. This approach has the merit of not distorting price positioning differences in Europe. But do countries always follow suit if they don’t see the benefits for themselves?

Finally, others, such as PHE, focus on centralising end-of-year rebates internationally. The simplest approach is to maximise their rebate by creating an additional layer to the local ones. But here again, with only limited growth in turnover for equipment manufacturers...

In short: do these various promises satisfy the equipment suppliers who finance them? If their view is anything to go by, there is still progress to be made. At the very least, they hope to benefit from the logistical savings promised by the harmonisation of flows within the IWDs...

Suppliers: how to resist

To keep control, equipment suppliers have every interest in playing the local game to the full so that they can maintain or even increase their market share through country-tailored promotional support, managed by their local teams in coordination with their central Key Account manager. But only when they can... because they are finding it increasingly difficult to finance such local teams. And this can irritate the ultra-directive nature of a distribution group.

The latter can, for example, cause an overly-independent supplier to lose its foothold in certain markets by making its product range unsuitable, thereby demotivating local teams. The general trend is therefore to reduce local presence, often considered too costly and futile, since the group is in control. But not all equipment suppliers have yet given up on fighting back. The most determined have understood that a strong brand has to be defended. And that when it is well defended, it imposes its value.

Retrouvez la version en Français : Groupements internationaux : Les équipementiers face aux géants de la distribution PR